December 3-December 16, 2014—

COLORADO REAL ESTATE JOURNAL

— Page 19

Finance

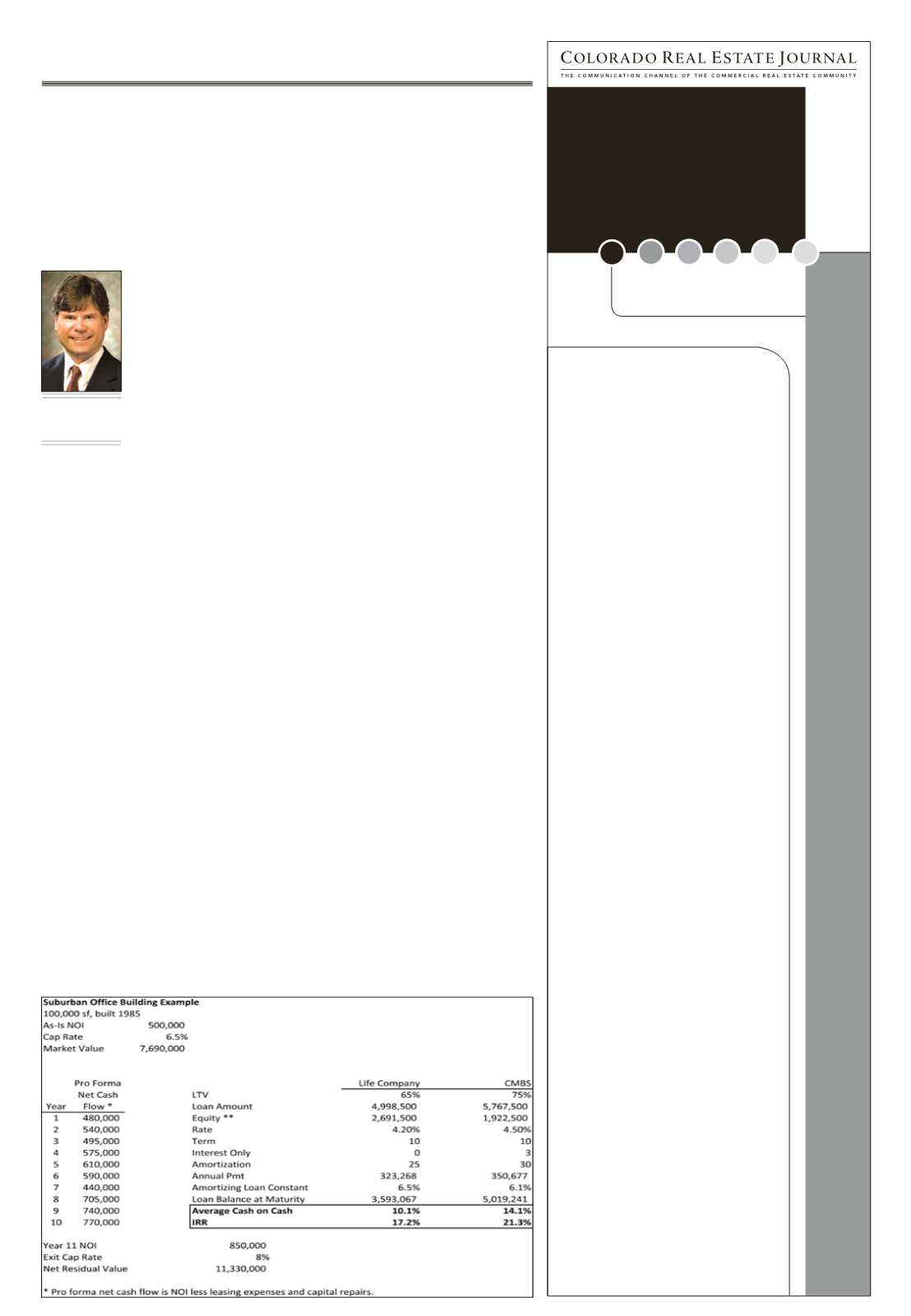

T

he commercial mort-

gage-backed securities

financing industry con-

tinued to gain market share in

2014. Several of the CMBS lend-

ers Essex Financial Group has

done business with have demon-

strated speed of execution, a high

level of deliv-

erability and

the ability to

provide bet-

ter econom-

ics compared

with alterna-

tive nonre-

course per-

manent loan

sources such

as life insur-

ance compa-

nies.

In addition,

several have a

wider variety of loan programs,

including on-book bridge loans

that can be converted to perma-

nent loans upon stabilization. A

handful of CMBS lenders are try-

ing to differentiate themselves by

developing alliances in the top

20 metropolitan statistical areas

with mortgage bankers that ser-

vice large loan portfolios. The

level of servicing quality and

the accountability with the origi-

nating mortgage banker/ser-

vicer continue to be the primary

strengths of a life company loan

and the weaknesses of CMBS

financing.

Strengths of a securitized loan

include:

• Speed of execution/efficient

processing – CMBS loans can be

closed in less than 45 days;

• Although the rate is typically

higher vs. a life company, the

higher leverage and interest-only

payment terms provide better

economics over the holding peri-

od (assuming exit is timed well);

• More flexibility on bor-

rower track record and financial

strength; and

• Multiple assumptions.

Weaknesses of a securitized

loan include:

• Servicing conflicts of inter-

est – lack of accountability and

conflict of interest with a master

servicer representing best interest

of first-loss position bondholders;

• Prepayment choices – defea-

sance or yield maintenance? Any

open prepayment term on the

back end of the loan or a step-

down fixed prepayment percent-

age are significantly cost prohibi-

tive;

• Higher transaction costs –

lender legal fees are usually twice

the amount vs. a life company;

• No rate lock (spread only)

until closing;

• Assumption timing takes

more than twice the time it takes

to originate a loan; and

• Master servicer has right

to change leasing and capital

improvement reserve structure

at loan

assumption.

Strengths of a life company

loan include:

• Rate lock at application;

• Lowest fixed rates;

• Longest terms (10 to 30 years

fully amortized);

• Loan commitment to confirm

deliverability prior to waiving

financing contingency;

• Prepayment choices and

more flexibility – yield mainte-

nance, open prepayment periods,

stepdown (5,4,3,2,1 percent years

six through 10);

• General account loan; and

• Usually locally serviced by

loan originator, which provides

borrower with better servicing

due to originating mortgage

banker’s accountability and

motivation to maintain and earn

repeat business.

Weaknesses of a life company

loan include:

• Acquisition time frames of

30-day due diligence and close

15 days later are very difficult

for most life companies to meet.

Most are reluctant to commit to

delivering a loan commitment

within 45 days;

• Some may sell a portion of

the loan to a third-party investor,

which can cause problems with

modifications or assumptions;

• Life companies get bought

and sold and staff changes over

time;

• Significantly more conserva-

tive underwriting;

• 30-year amortization terms

are limited to lower leverage

and/or higher-quality proper-

ties;

• Higher-quality properties

and borrowers required;

• More location sensitive – pre-

fer top 20 MSAs and are very

selective in secondary markets;

• Higher levels of leasing capi-

tal reserves on high-leverage

loans;

• More conservative structur-

ing around major tenant rollover

risk; and

• Interest only is challenging

above 65 percent loan to value on

most product types.

The main tradeoff with a secu-

ritized loan is a lack of future

lender flexibility in the event the

borrower’s business plan goes in

the wrong direction. Life insur-

ance loan servicing is typically

more efficient and the servic-

ing contact is experienced and

motivated to assist with solving

unforeseen problems.

Life insurance company loans

are usually originated as “general

account” loans where the lender

retains 100 percent of the loan

amount on their books through

the loan term. However, it’s not

unusual for some life companies

to sell a portion of the loan to a

third-party investor, which can

create problems with layers of

approval on situations such as a

loan assumption or an interest-

only payment request if the cash

flow is temporarily low.

Life insurance company loans

are typically the best lending

sources for borrowers requesting

lower-leverage permanent loans

at the lowest interest rate that will

be serviced by an experienced

staff with an alignment of inter-

est. CMBS loans usually provide

better economic terms at leverage

levels life companies won’t offer.

However, senior management

ethics vary and some are known

to retrade for sport. Choosing a

lender with a track record with

the mortgage banker is impor-

tant. Choosing a mortgage bank-

er that can provide full cashier-

ing servicing might be just as

important. This provides a local

mortgage banker that also has a

local servicing group with more

administrative control.

All investors would prefer a

permanent fixed-rate loan that’s

serviced by the lender that origi-

nates the loan by a qualified and

experienced staff that operates

efficiently and in a timely man-

ner. If the CMBS industry finds

ways to provide better servicing

via local mortgage bankers that

have local servicing groups, they

could likely take more market

share from life companies. Right

now they’re just winning on eco-

nomics and willing to do deals

life companies won’t.

s

Peter Keepper

Managing principal,

Essex Financial Group,

Denver

For Company Profiles, Contact

Information & Links, Please Visit

Commercial Real Estate

Lenders

Directory

COMMERCIAL REAL ESTATE LENDERS DIRECTORY

If you would like to include your firm in this directory,

please contact Jon Stern at 303-623-114

@

Academy Bank

Acre Capital LLC

Bank of Colorado

Bank of the West

Berkadia Commercial

Mortgage, LLC

Capital Source

CBRE|Capital Markets

Chase Commercial Term Lending

Colorado Business Bank

Colorado Lending Source

Commerce Bank

Commercial Federal Bank

Essex Financial Group

Fairview Commercial Lending

FirstBank Holding Company

Front Range Bank

Grandbridge Real Estate Capital LLC

Heartland Bank

JCR Capital

Johnson Capital

KeyBank N.A., Key Commercial

Mortgage Inc.

Merchants Mortgage and Trust Corp.

Montegra Capital Resources,

Private Lender

Mutual of Omaha Bank

NorthMarq Capital, Inc.

Principal Partners Lending

TCF Bank

Terrix Financial Corporation

Trans Lending Corporation

U.S. Bank – Commercial Real Estate

U.S. Bank SBA Division

Vectra Bank Colorado, N.A.

Wells Fargo SBA Lending

Wells Fargo N.A. – Commercial

Real Estate Group

West Charter Capital Corp.