October 2015 — Office Properties Quarterly —

Page 17

®

Celebrating 60 Years as Denver’s

Name in Commercial Real Estate.

Proud to still be locally owned and operated.

Stay tuned as we prepare for our next 60 years

with the relocation of our headquarters to the

Denver Tech Center.

(303) 534-4822

Market Drivers

D

enver’s highly educated

workforce is drawing a

steady flow of companies

to the metro area and con-

tributing to an increased

demand for office space. In Denver’s

thriving business community, many

companies are outgrowing their

current leases.

Transamerica Corp., for example,

announced that it will be mov-

ing from the Denver Tech Center,

a business and economic trading

center in the southeastern portion

of the Denver metropolitan area, to

downtown Denver. The company

will lease 121,000 square feet in the

1801 California St. tower. The move

will enable the company to hire an

additional 325 workers, doubling its

local workforce. In

addition, Comcast

will consolidate its

local operations

in an office in the

DTC, increasing its

overall footprint

and workforce.

Overall, employ-

ers in Denver will

add 45,000 jobs

this year, boost-

ing total employ-

ment 3.3 percent.

Total office-using

employment will

advance 2.1 percent, or by 8,000

workers.

The confidence of developers in

the metro remains high amid tight-

ening operations. Several projects

broke ground recently; a good deal

of those are starting with little or

no preleasing. Builders are on the

hunt for transit-oriented areas

along the light rail.

Other construction projects are

build-to-suit, such as the project

for Panasonic Enterprise Solutions,

a subsidiary of Panasonic Corp.,

which will open a new technology

center and business solutions hub

at the Peña Boulevard light-rail sta-

tion near Denver International Air-

port. The facility will be completed

in the summer of 2016, enabling the

company to fill 330 positions.

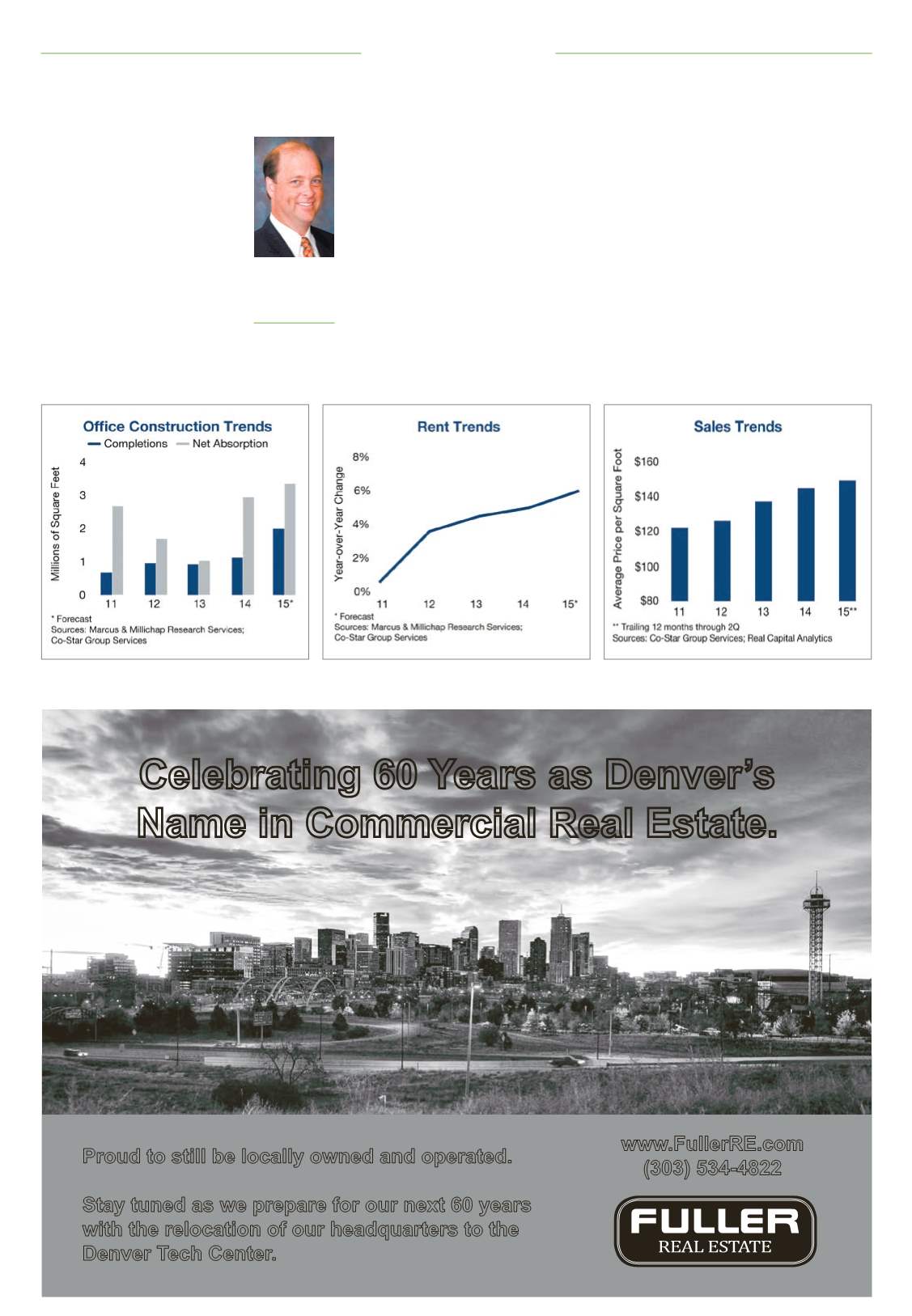

In total this year, developers are

set to raise office stock 1.3 percent

with the completion of 2 million sf,

compared with approximately 1.1

million sf in 2014. Roughly 3 million

sf of office space is underway. Only

about 50 percent of the total is pre-

leased.

Denver’s economy, favorable

yields and strong operations are

attracting nationwide attention

from investors. Many financial

institutions are easing lending stan-

dards for office properties, which

supplies buyers with more capital

to make purchases as rising compe-

tition pushes prices higher.

The interest from institutional

buyers is prominent near down-

town and the DTC. Well-priced

properties bring numerous offers

Brian C. Smith,

CCIM

Senior associate,

Marcus &

Millichap, Denver

Office construction in Denver from 2011 to 2015

Metro Denver office rent growth from 2011 to 2015

The average price per square foot for office sales in Denver