Page 14 —

COLORADO REAL ESTATE JOURNAL

— November 19-December 2, 2014

Boulder County & U.S. 36 Corridor

by Jill Jamieson-Nichols

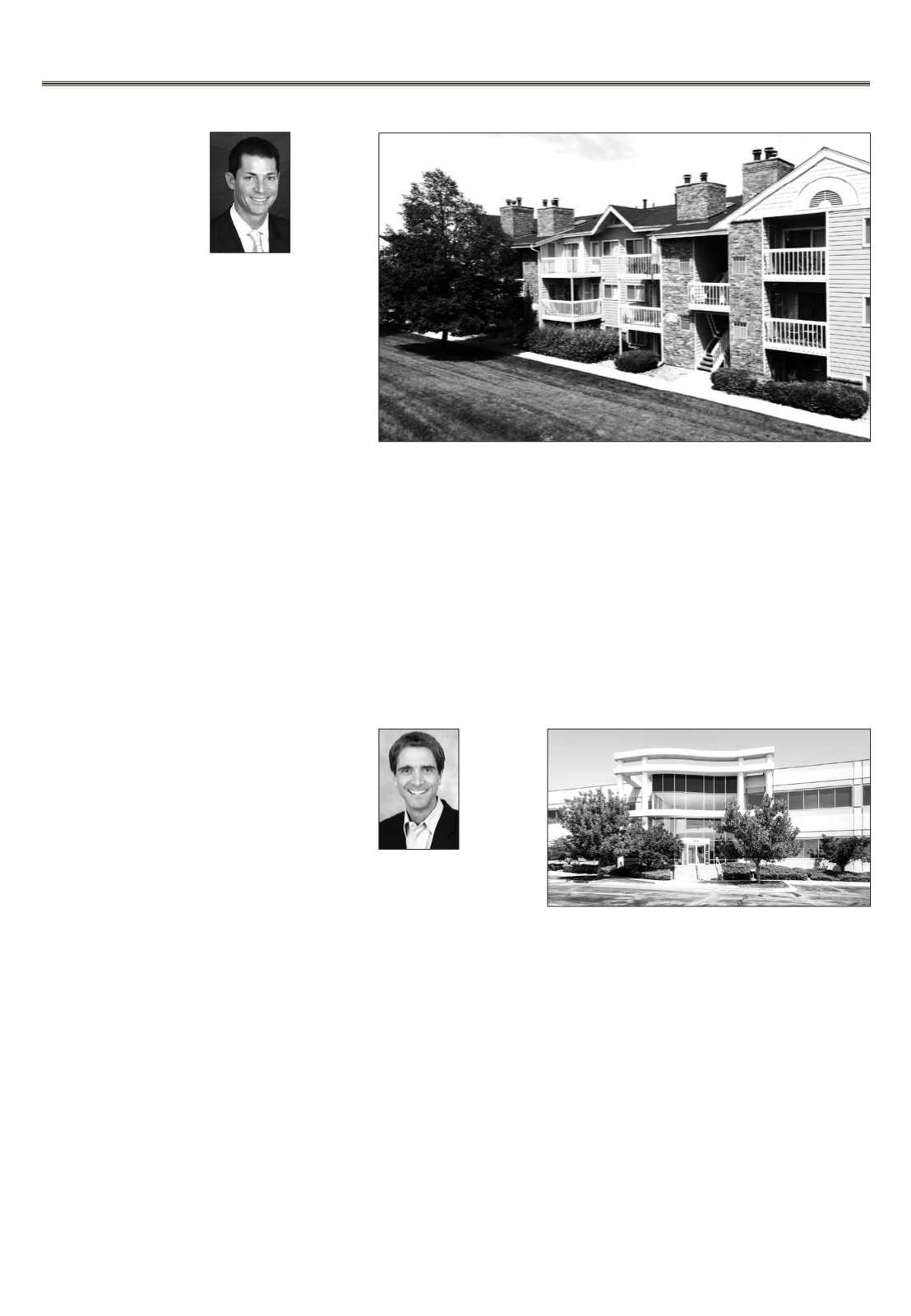

Advenir, a multifamily real

estate investment and manage-

ment company, picked up 570

apartment units with the pur-

chase of two communities in

Longmont.

Advenir didn’t release the

price it paid for the proper-

ties, but industry sources said it

was approximately $80 million.

CenterSquare Investment Man-

agement was the seller.

The deal included the former

Wyndam Apartment Homes,

now Advenir@Wyndam, and

Wildwood Apartment Homes,

which was renamed Advenir@

Wildwood.

Advenir has acquired 1,000

apartment units in the greater

Denver area since August and

nearly 3,000 units since late

2011. It is actively looking to

expand its portfolio.

“We are very bullish on the

greater Denver apartment mar-

ket with its strong fundamen-

tals, high barriers to entry and

excellent demographics,” said

Todd Linden, chief acquisition

officer. “The Longmont apart-

ment market has seen year-

over-year growth of 7.9 percent

and very low vacancy levels

of 3.5 percent,

providing an

opportunity

to own an

asset in a sta-

bilized mar-

ket with sig-

nificant rental

upside.”

Adveni r@

Wyndam is

an 18-build-

ing, 360-unit community at 2540

Sunset Drive. Built in 1990, it

underwent a renovation in 2010

that included comprehensive

upgrades to individual units as

well as the common areas. The

property has 156 one-bedroom,

one-bath units and 204 two-

bedroom, two-bath units. Ame-

nities include a swimming pool,

spa, clubhouse, fitness center,

carport, access to public trans-

portation and nearby parks.

Advenir@Wildwood is a

15-building, 210-unit Class

B-plus property at 3226 Lake

Park Way. The units, as well as

the exterior and common areas,

recently were renovated. The

apartments feature a loft-style

design that is unique to the

area, with 126 one-bedroom,

one-bath units and 84 two-bed-

room, two-bath apartments.

Advenir@Wildwood is adja-

cent to McIntosh Lake, provid-

ing tenants with recreational

options, and is surrounded

by major retail, restaurants,

employers and transportation

infrastructure.

Eric Tupler and Josh Simon

of HFF secured Freddie Mac

financing for the acquisition.

Jordan Robbins, also of HFF,

represented the seller.

Advenir, headquartered in

Aventura, Florida, acquires and

operates income-producing

assets throughout the United

States on behalf of high-net-

worth and institutional inves-

tors. Its current portfolio con-

sists of 8,406 units valued at

more than $800 million.

s

Advenir acquired 570 apartment units in Longmont with its purchase of the former Wyndam and Wildwood

Apartment Homes.

Todd Linden

by Jill Jamieson-Nichols

An Anchorage, Alaska-based

commercial real estate invest-

ment and management com-

pany bought a three-building

industrial property in Boulder.

Carr Gottstein Properties

paid $7.15 million for Twin

Lakes Business Park, which

consists of 71,447 square feet

of office/warehouse space in

three buildings in Gunbarrel

Business Park. WLA Invest-

ments sold the property, which

is located at 4695, 4697 and

4699 Nautilus Court.

Twin Lakes Business Park

was 100 percent leased to 19

tenants, including Asher Brew-

ing Co.

“We had great activity,” said

Patrick Devereaux of JLL, who

represented the seller with JLL’s

Jason Schmidt. “The property

was in excellent capital condi-

tion. The existing ownership

had done significant improve-

ments to the asset over the last

three years,” he said. “It’s a

good piece of real estate.”

Average rents are about $1

per sf below market, according

to Devereaux.

“Twin Lakes Business Park

will provide the buyer with

very durable long-term cash

flow and significant upside

potential as the market in Boul-

der continues to tighten,” he

said.

According to CoStar Group,

the industrial vacancy rate in

Boulder has been dropping

since 2009 and currently stands

at less than 2 percent.

Twin Lakes Business Park

averages approximately 30

percent office build-out, with

70 percent warehouse space. It

was built in 1983.

Brian Bair, Dax Gitcho and

Trent Rice of NAI Shames

Makovsky represented the

buyer in the transaction.

s

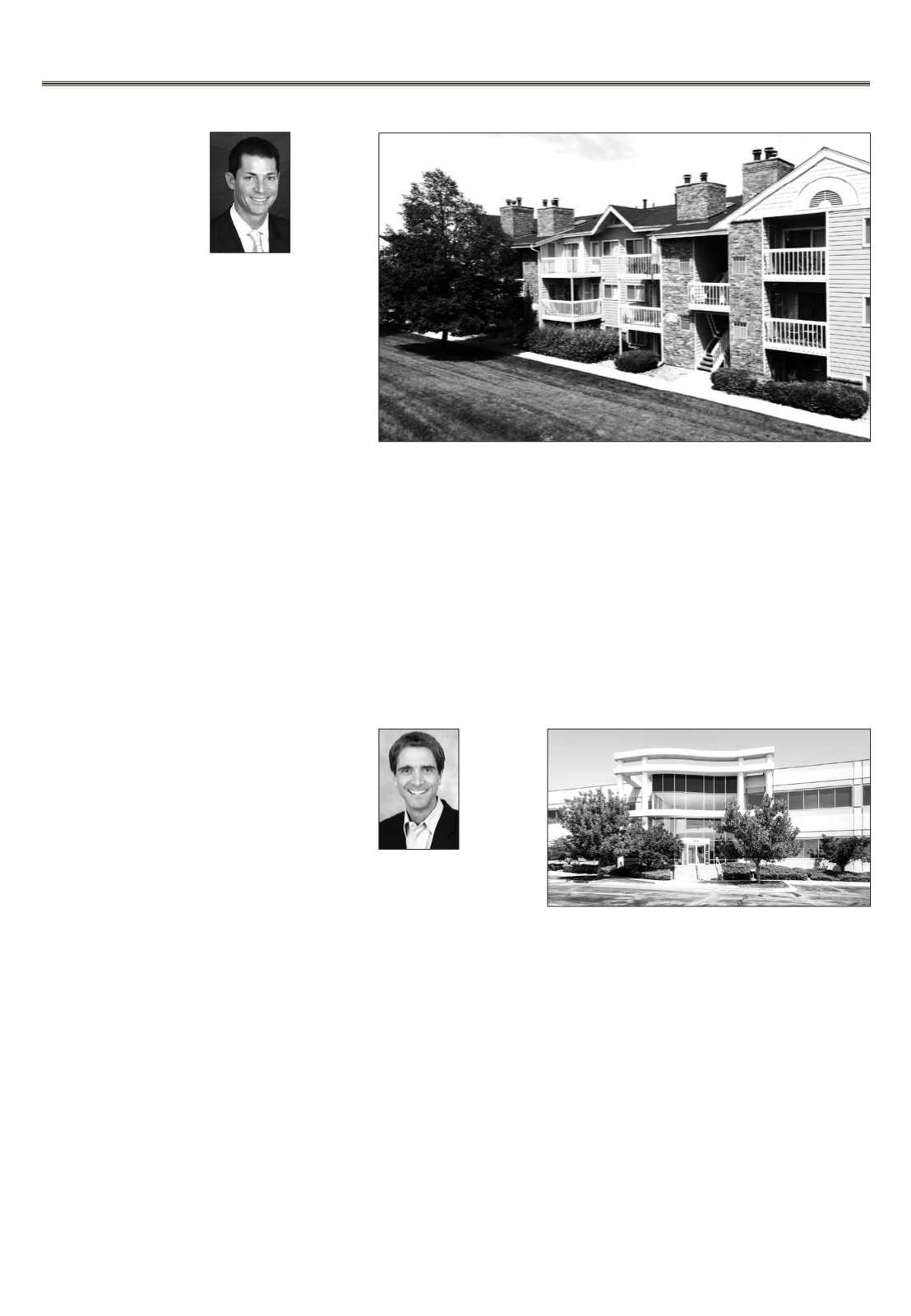

by Jill Jamieson-Nichols

A company that has been

steadily expanding at West-

moor Technology Park over the

last decade will relocate next

door to continue its growth tra-

jectory.

Reed Group, a multifaceted

firm that provides information

and services related to employ-

ee leave and disability, leased

65,000 square feet at 10355

Westmoor Drive in Westmin-

ster with an obligation to take

another 10,000 sf within the

next three years. It currently

has 55,000 sf at Westmoor.

“The location works really

well for Reed Group. We’ve got

great access to workforce,” said

CEO David Roberts, explaining

the company draws employees

from both the Boulder and Den-

ver areas.

Of the approximately 400

people it employs in Colorado,

approximately 330 work in the

office. “We’ve been growing

about 20 percent year over year

for the last four years. We will

probably add 100 or 150 people

over the net 12 months, so that

will continue to go up,” Roberts

said.

ReedGroup

p r o v i d e s

emp l o y e r s

with a vari-

ety of leave

and disabil-

ity services

and products,

i n c l u d i n g

We b - b a s e d

information;

th i rd-par ty

management of leave and dis-

ability services; software to help

companies and insurers man-

age their own leave and disabil-

ity matters; and data and ana-

lytics tools to help employers

understand causes of employee

absence. The goal is to improve

return-to-work outcome, lower

absence and health care costs,

and drive better business

results.

The workforce includes cus-

tomer service and technology

personnel, as well as a large

number of nurses.

“Our employees really get a

lot of value out of the help

that they provide,” said Rob-

erts, who said employees enjoy

assisting people suffering

from disabilities and dealing

with other work-leave issues.

“Everybody really feels like

they are doing good. It’s a spe-

cial part of Reed Group and a

special part of why we’ve been

successful and grown,” he said.

Reed Group expects to occu-

py its new offices in the first

quarter of 2015. The company

will be located in a 97,922-sf

building that was built in 1999

and is part of a collection of

buildings known as Westmoor

Center. Westmoor’s amenities

include a deli, West View Recre-

ation Center, showers and lock-

ers, enclosed bike shelters, 3½

miles of trails and a golf course.

Todd Papazian of CBRE in

Denver and Ted Uzelac of Fisch-

er & Co. in Dallas represented

Reed Group in the lease. Frank

Kelley and Austin Fairbourn,

also of CBRE, represented the

landlord, KBS Strategic Oppor-

tunity REIT.

When it first moved to West-

moor 10 years ago, Reed Group

occupied 24,118 sf.

“It’s a nice business,” said

Roberts. “It’s just growing and

growing. It’s fun to be in a busi-

ness where you’re successful

and growing.”

s

Reed Group will expand into the building at 10355 Westmoor Drive in

Westminster.

David Roberts

by Jill Jamieson-Nichols

WhiteWave Foods executed

a 50,324-square-foot lease in a

new speculative industrial/flex

building at 1900 Cherry St. in

Louisville.

The lease is the first to be signed

for the 66,350-sf building, which

Etkin Johnson Real Estate Part-

ners completed in September. It

will commence March 1.

WhiteWave, which produces

food brands including Horizon,

Silk, Alpro and others, will use

the facility for food preparation,

research and testing. The build-

ing is located at the southwest

corner of CTC Boulevard and

Cherry Street in the Colorado

Technology Center.

The tenant occupies space in

another Etkin Johnson building

in Broomfield, and that relation-

ship contributed to the lease exe-

cution, the developer said.

“We are very pleased to be

able to accommodate an exist-

ing tenant with an expansion

solution within our portfolio,”

Ryan Good, Etkin Johnson vice

president of leasing and sales,

said in an announcement. “Our