April 2015 — Office Properties Quarterly —

Page 27

Development

T

he Southwest Energy Effi-

ciency Project recently pub-

lished a set of fact sheets

that examine commercial

construction activity in the

Southwest. As a whole, the six-state

region has a relatively low popula-

tion of about 20 million, yet in 2013

investors poured $11.3 billion into

commercial construction projects.

Wyoming, Colora-

do and Utah expe-

rienced the biggest

increases in com-

mercial construc-

tion projects in the

region. In 2013, the

total value of all

commercial con-

struction projects

in Colorado was

about $3.2 billion.

Looking spe-

cifically at office

projects in the

private sector, the

total value of all

new construction and renovation

projects in Colorado was just over

$220 million in 2013. Note that, in

the CMD database, office buildings

do not include medical, military or

warehouse offices. When govern-

mental offices are included in the

calculation, the total value of all

new construction and renovation

projects in the state was over $342

million for the same year.

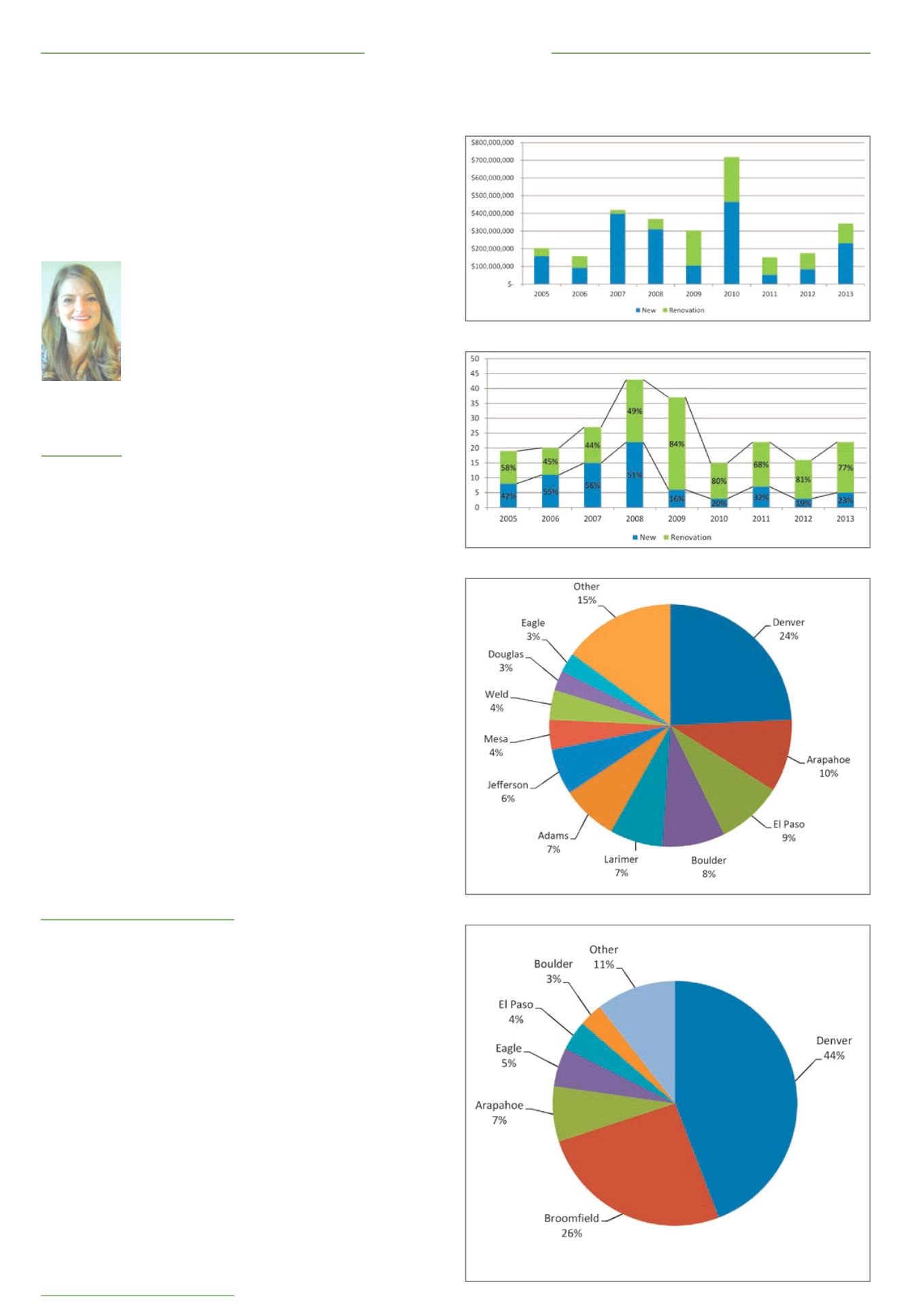

In the private sector, the propor-

tion of renovation projects to new

construction projects has grown

since 2009, but new construction

projects still account for the bulk of

total project value. This means that

the total number of office renova-

tion projects is increasing, but proj-

ect costs are much higher for new

construction projects because they

comprised 90 percent of the total

private project costs in 2013. When

public-sector office buildings are

included, the proportion of renova-

tion projects increases significantly

in all years from 2006 to 2013, and

most significantly from 2009 to 2013

(renovations make up 86 to 92 per-

cent of projects in these years). In

fact, 92 percent of all office projects

constructed in 2013 were renova-

tions when governmental offices

are included.

In terms of cost, new construction

projects comprised about 68 per-

cent of the total office construction

value in 2013 when governmental

offices are factored into the analy-

sis. In this case, renovations are

driving the market more so than in

the private sector.

The CMD data also classifies com-

mercial projects by county so that

trends in construction by geograph-

ic area can be evaluated. This begs

the question: Where in Colorado is

the most office building construc-

tion occurring?

Well, that depends on how you

look at it. Regarding the number

of project starts or the total num-

ber of projects, the top counties in

descending order are: Denver (24

percent), Arapahoe (10 percent),

El Paso (9 percent), Boulder (8 per-

cent) and Larimer (7 percent). This

means that more office projects are

constructed in these counties than

other counties in the state.

Regarding the total sf constructed,

the top counties in descending

order are: Denver (44 percent),

Broomfield (26 percent), Arapahoe

(7 percent), Eagle (5 percent) and El

Paso (4 percent). This means that

more office space is constructed in

these counties than other counties

in the state. These statistics were

generated using years 2005 to 2013,

and square footage estimates are

available for new construction proj-

ects only.

Overwhelmingly, and perhaps not

surprisingly considering its popu-

lation, Denver surpasses all of the

other counties in Colorado when it

comes to office building construc-

tion. This is also true by total proj-

ect cost for years 2005 to 2013, dur-

ing which Denver represents about

52 percent of the total project value

in the state for office buildings.

There is not considerable vari-

ance in the top counties for office

construction when governmental

offices are included, except that Jef-

ferson County (and not Arapahoe

County) is in the top five counties

for number of projects, and Boulder

County (and not Eagle County) is in

the top five counties for total proj-

ect value or cost.

As to private office building size,

the trend in Colorado is similar to

that of the region. There is a high

number of small office projects

being constructed, but the largest

office buildings comprise a high

percentage of total sf constructed.

Almost half of the private sector

office projects in Colorado are less

than 25,000 sf (41 percent), but

buildings in the 500,000 sf to 1 mil-

lion sf range represent the largest

portion of total sf. These statistics

were generated using years 2005 to

2013, and sf estimates are available

for new construction projects only.

In summary, 2013 showed:

• An increase in total project value

when looking at office construction

(new construction and renovations);

• A high percentage of office proj-

ects are renovations, especially in

the public sector;

• Denver is the top county in

Colorado for office building con-

struction, and Broomfield office

buildings account for a considerable

percentage of office building con-

struction in terms of sf;

• Most office buildings construct-

ed are 250,000 sf or less (86 per-

cent); and

• The largest buildings of 250,000

sf or more comprise about 70 per-

cent of the total sf constructed from

2005 to 2013.

s

A look at Colorado’s robust office constructionLauren Smith,

LEED AP BD+C

Program associate,

Southwest Energy

Efficiency Project,

Denver

Total office project cost by year (private and public sectors)

Number of office projects by year (private sector)

Top counties by number of projects (2005-2013)

Office building size in square feet by number of projects

This means that the

total number of office

renovation projects

is increasing, but

project costs are

much higher for new

construction projects

because they

comprised 90 percent

of the total private

project costs in 2013.