May 2015 — Property Management Quarterly —

Page 25

M

odern business depends

on technology. Servers,

desktops, notebook com-

puters, tablets and phones

are essential to everyday

workloads and doing more with less.

Any disruption to these tools can

cause extreme stress to an already

overworked employee or team. If your

building has a fire, water damage,

construction mis-

hap or any number

of possible disasters,

it affects your ten-

ants.

What is Your

Liability?

When damage

to technology that

runs a business

occurs, there are

more factors to

consider than just

hardware. These are

referred to as soft costs and include

software installation, network con-

figuration, data recovery and transfer,

employee profile setup, license and

maintenance contracts, and warran-

ties.

All these soft costs affect the bigger

concern – business interruption. How

long can a business be down before

it affects income? It could be weeks,

days or just hours.When asked, most

companies will say, “Never, we can’t

be down at all!” Just the thought of

being without your equipment for two

days without warning is a bit unnerv-

ing, much less to experience it.

How quickly a company can get

back to business depends on whether

it has a plan in place for disasters.

Larger companies may have them,

and sometimes the companies are

required by law to have such plans

in place. However, small businesses

make up 99 percent (according to the

U.S. Small Business Administration) of

the U.S. employers, and without the

requirement it leaves small business

owners at a disadvantage when disas-

ter strikes.

If the mishap occurs as the fault of

the business, then its insurance should

take over. However, if something goes

wrong with the building, what is your

liability? Subrogation is a big deal in

the insurance world, and you can bet

if there is the opportunity to shift the

cost of damage to someone else, you

can count on it.

Let’s look at it this way, if your build-

ing is damaged, you fix it because

it’s your building. But what about the

contents inside the building? If a loss

occurs due to maintenance issues, are

you required to foot the bill? If so, how

do you make sure all quotes are cor-

rect and in the best interest of claim

mitigation? Vendors that install and

sell equipment for a living are not like-

ly to be worried about costs, especially

in an insurance situation.You need to

make sure cost-effective solutions are

considered.

Chances are you have dealt with

contractors before and have a handle

on the construction side of things.

But what about the building contents

– more specifically, what about the

information technology and busi-

ness technology used in the environ-

ment. There are several questions

that should be answered quickly to

minimize business interruption and

larger costs to the claim, including was

there technology affected by the loss;

to what extent; can it be fixed and put

back in operation quickly; and are ven-

dors involved?

Vendors provide a valuable service,

but remember, they sometimes may

see a loss as a sales opportunity and

may suggest upgrades that are not

necessary, or suggest replacement of

items that are not needed. This can

increase the cost significantly due to

lack of experience with these types

of situations. Due diligence needs to

be done. Instead of replacing it all,

you should look at what was really

affected and what wasn’t affected. Ask

yourself:

• How bad is the damage?

• Can items be used right away?

• Can items be restored and put back

into use as soon as possible?

•What needs to be replaced?

• How long will it take to get back up

and running?

If equipment is replaced, the fol-

lowing eight questions should be

addressed:

1. How long until the hardware can

be delivered?

2.What configuration needs to be

done to each component?

3.What software needs to be

installed?

4. Are upgrades to the equipment

necessary?

5. Are the technologies compatible

with each other?

6. Is data recovery needed from the

old equipment, and how quickly can

that be done?

7. Do user profiles have to be set up

on the workstations again?

8. Are there any network configura-

tions needed for the equipment?

Replacement equipment can take

weeks to arrive and set up, which may

delay the business from operating for

the same amount of time. Calculate

the hardware costs plus the soft costs

and add in the days or weeks of lost

revenue to have a better idea of how

the claim quickly can escalate in cost.

From a standpoint of minimizing

business interruption and claim costs,

the quickest way to get back up and

running is to use the original equip-

ment. This equipment is already con-

figured, and has all of the software and

profiles intact. Proper inspection and

restoration of the hardware should

help it live a normal life, barring any

permanent damage from a direct

hit by water or heat. In a loss that

is handled properly, there may be a

mixture of recovery and replacement.

Using the original equipment is usu-

ally a quicker and more cost-effective

option, equaling a fraction of replace-

ment, especially when considering the

soft costs. If technology is addressed

quickly after a loss and contaminants

cleaned from circuit boards properly,

odds are the original equipment can

be restored to a preloss condition. A

proper investigation of loss involving

technology should flow like this:

1. Determine what equipment was

affected.

2. If equipment was affected, what

can be repaired and recovered cost-

effectively?

3. Create a plan to restore operations

to enable workflow to continue.

4. Is after-hours on-site mitigation

necessary?

5. Order equipment that needs to be

replaced as soon as possible.

6. Plan different phases to get full

operations back into working condi-

tion.

7. Make sure there are no compat-

ibility issues with a mix of new and

old technology.

8. Test and use the systems to make

sure all operations are back to normal.

Sometimes the knee-jerk reaction to

a loss involving water or smoke is to

replace it all.While this may be great

to get a system upgraded and new,

it is not the best option to save time,

money or the hassle that comes along

with new equipment. Costs associated

with the loss will skyrocket.Your job

is to minimize costs while effectively

returning your tenants business to

normal operations.

As we have discussed, there are

many considerations to determine

what the quickest and most cost-

effective way to get business technol-

ogy systems back up and running after

a loss. Make sure the vendors involved

take all of these considerations into

account.

There are also measures your ten-

ants can take to proactively protect

against damage. More information and

a free checklist to hand out to business

tenants are available at MinimizeBI.

com.

s

How to quickly mitigate technology lossesTechnology

Cory Matthews

Technical director,

RescueTech,

Denver

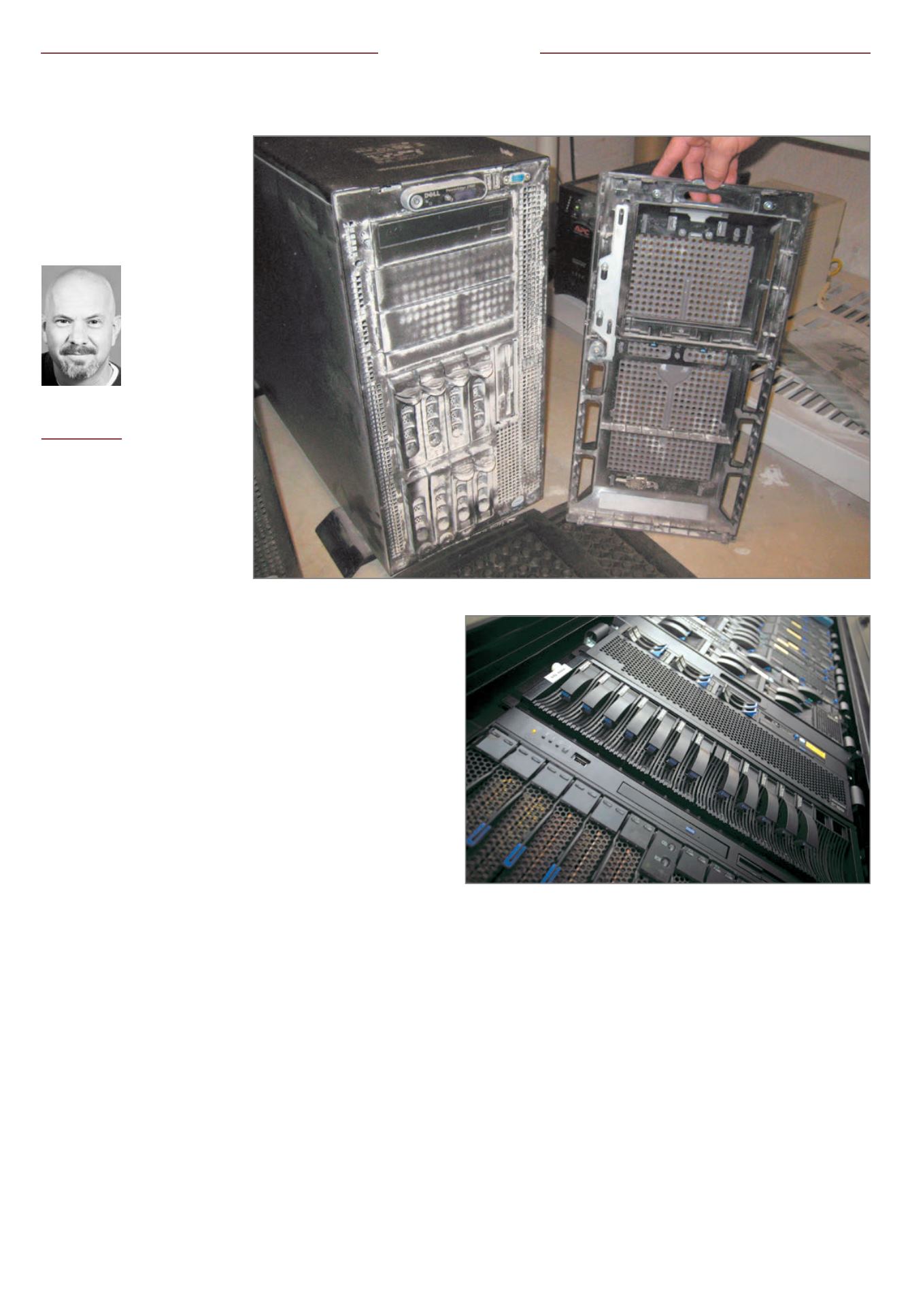

Proper containment during construction and remodels can help avoid situations like construction dust contamination.

Replacing everything, including servers, after a disaster is not always the best plan.