Page 22 —

COLORADO REAL ESTATE JOURNAL

— March 16-April 5, 2016

Finance

by John Rebchook

Financier Jordan Ray knows

Aspen, even though he is based

in New York City.

Parents of friends used to take

him toAspen to ski when he was

in high school and it remains one

of his favorite places in the coun-

try to hit the slopes.

“I’m going toAspen next week

to ski,” Ray, the managing direc-

tor of the debt and equity finance

group at Mission Capital, recent-

ly told the Colorado Real Estate

Journal, in a phone interview

from his office in New York.

Ray also has a professional

interest in Aspen.

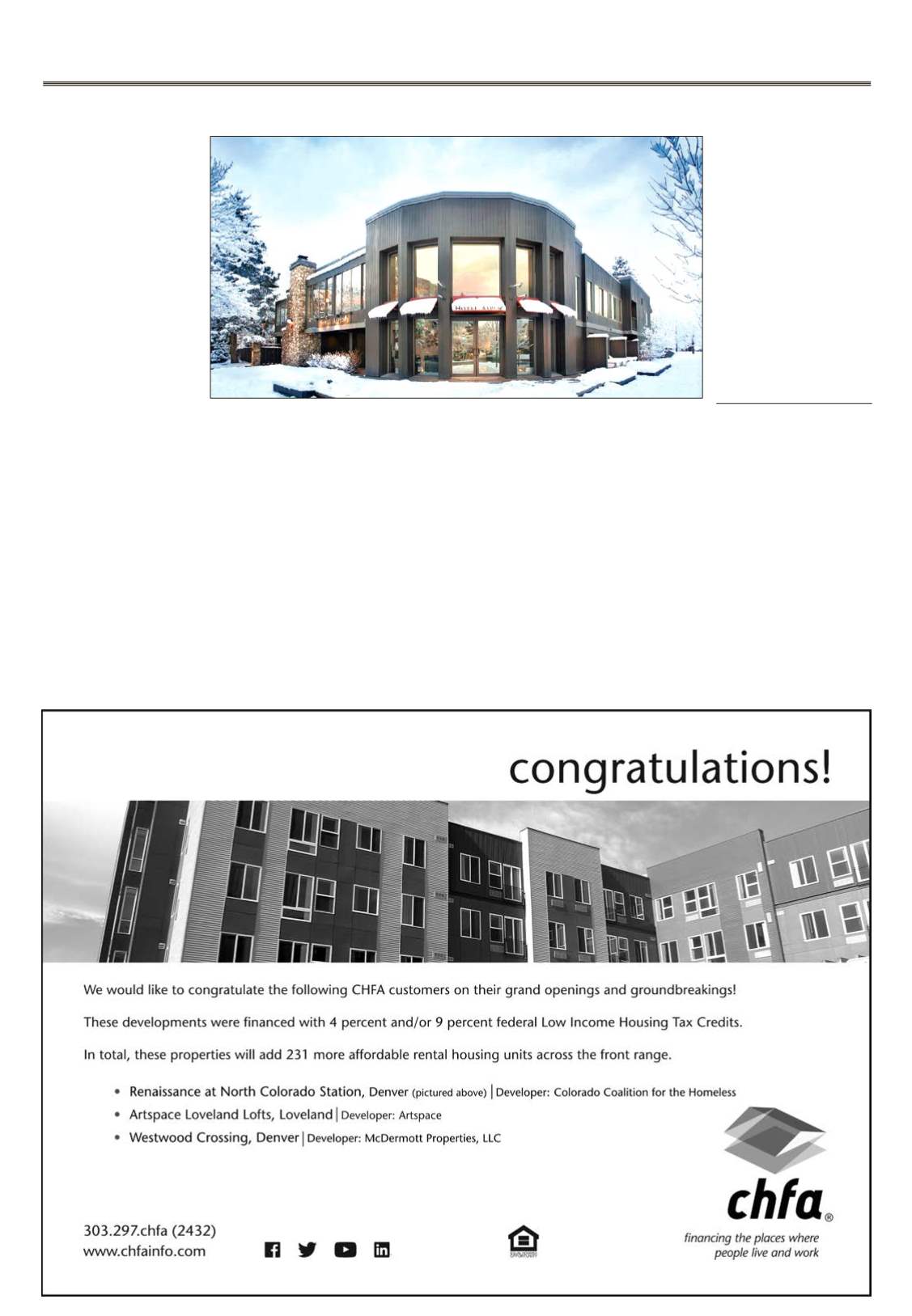

He was recently part of the

Mission Capital team, which

also included Ari Hirt, Steven

Buchwald and Jamie Matheny,

that made a $10.23 million loan

for the 45-key Hotel Aspen, a

boutique hotel at 110 W. Main

St., at the entrance of Aspen’s

downtown.

The hotel is owned byHaymax

Capital LLC, headed by broth-

ers Michael and Aaron Brown,

according to public records.

“The quick story is that we

have known the sponsors, who

own this asset, for a while,” Ray

said.

Haymax also owns another

hotel across the street that it had

attempted to sell, he noted.

It was marketed by another

broker but they weren’t able to

sell it for the price they wanted,

he said.

“They hired Mission to refi-

nance this asset,” which had

debt coming due, he said.

”We were able to produce a

number of competitive offers

from debt funds and banks,”

Ray added.

“Ultimately, we arranged a

great nonrecourse, 10-year fixed-

rate prepayable loan from a

regional bank at a very low rate,

retiring the property’s existing

loan and returning capital to the

sponsor.”

The loan carries an interest

rate in the low 4 percent range,

he said.

Plus, it is very flexible.

“It is just great debt,” Ray said.

“In the future, if they want

to sell the asset and prepay the

loan,” they can do so without a

prepayment penalty, he said.

The loan was a bit of a chal-

lenge because the borrowers

wanted a nonrecourse loan, with

a low interest rate and no pre-

payment penalty, he said.

“It was a bit of a challeng-

ing transaction, but we like chal-

lenges. And we like Aspen,” Ray

said.

Mission delivered on every-

thing the borrower wanted.

“It is a fantastic deal,” Ray

said.

He said that Mission received

nine quotes from groups inter-

ested in making the loan.

The loan was on the small side

for Mission, which since it was

founded in 2002 has arranged and

structured more than $5 billion in

real estate loans on behalf of own-

ers, investors and developers.

“I would say our average piece

of financing is in the $30 million”

range, Ray said.

“We do a lot of transactions,

and while $10 million is on the

small side, we also do transac-

tions in the $100 million range,”

he said.

He said most of their business

is based on relationships.

“We are based in New York,

but more than half our business

is from outside of New York, all

around the country,” Ray said.

In fact, a lot of their recent busi-

ness has been for apartments

in Los Angeles and Las Vegas,

according to Mission’s website.

Mission hopes to do more

deals in Colorado’s mountain

resorts, as well as in the Denver

area, Ray said.

“Absolutely,” Ray said. “We

love the mountains and love the

Colorado market. We see more

opportunity in the West than

we do in the East. We are even

considering opening an office

in Denver to better cover that

Rocky Mountain region. We love

Denver and we love Salt Lake

City.”

When he was younger, he had

never stayed at Hotel Aspen.

However, he had stayed at the

Molly Gibson Lodge across the

street, which is also owned by

Haymax.

“They own clean and nice

hotels that are at a lower price

point than the Little Nell.”

Other News

n

Greg Benjamin,

senior vice

president, and

Jeff DeHarty,

associate producer, in the Den-

ver office of

NorthMarq Capital

arranged $23 million in perma-

nent financing for the Park Place

Olde Towne Apartments at 5743

Teller St. in Arvada.

The five-story building has 153

units.

Benjamin

and

DeHarty

arranged the financing through

their long-term correspondent

relationship with a major Mid-

western life insurance company.

n

Catherine Murphy

of

Chase

recently arranged about $12.5

million in financing in eight sep-

arate apartment transactions. All

of the loans are amortized over

Shown is the Hotel Aspen.