by John Rebchook

Last year was one for the

Denver-area

multifamily

housing record book.

Investors paid a record $4.44

billion for apartment commu-

nities in the metro area last

year, topping the previous

record set in 2014 by $903 mil-

lion, a 25.5 percent jump.

The record pace is becoming

a bit of a broken record, albeit

a welcome one for sellers.

“During three of the past

five years, the metro Denver

apartment market has set

a record for sales volume,”

pointed out Jeff Hawks, vice

chairman at ARANewmark’s

Denver office.

It’s not unusual for records

to be driven by the sale of a

handful of core assets, such

as properties in downtown,

which command high pric-

es. That is true in other asset

classes, such as offices, as well

as for apartments.

However, the apartment

market soared to a record

level without any high-profile

downtown deals skewing the

numbers.

“We sold three buildings

over $300,000 per unit in 2015

and not one of them was a

'core' downtown deal,” said

Terrance Hunt, a broker with

ARANewmark.

That could change this year.

"I estimate that we will see

three or four downtown sales

this year and these deals will

sell at record prices,” Hunt

said.

“This could be the year

Denver breaks through the

$400,000-per-unit level,” Hunt

said.

While no core downtown

properties sold last year, Shane

Ozment, a partner with Hunt,

Hawks and Doug Andrews

for the past 15 years, has wit-

nessed the rapid appreciation

of suburban, garden-style

properties.

“In early 2015, there had

never been a garden-style,

suburban apartment property

that sold for over $220,000 per

unit,” Ozment said.

“In the past six months,

ARA Newmark brokered

sales for $228,000, $253,000

and $260,000 per unit.

“And in January of 2016, we

closed Outlook Littleton for

$289,000 per unit,” Ozment

said of the new high-water

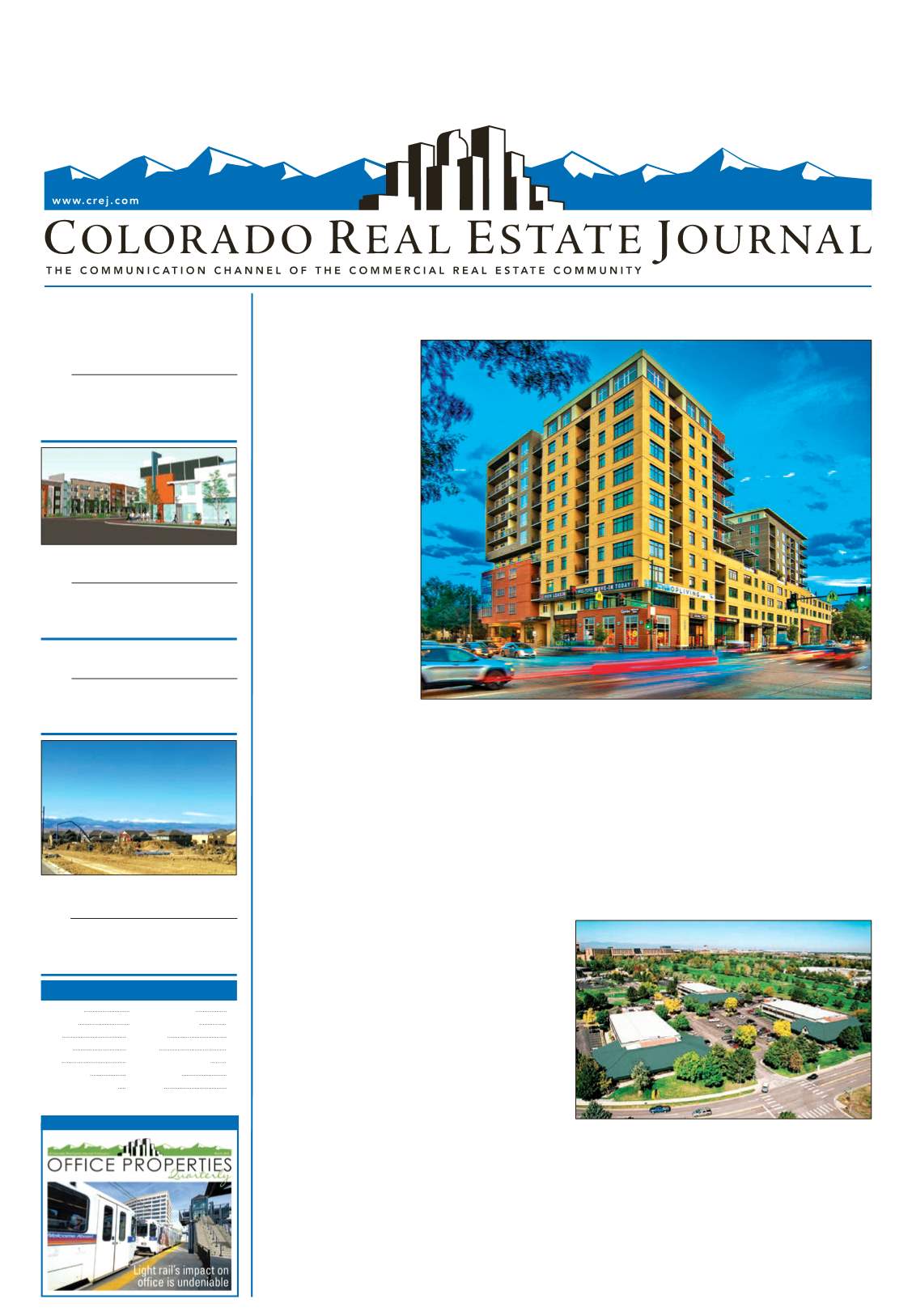

Shown is One Observatory Park near DU, which late last year set a sales record for a nondowntown,

core-asset apartment building.

by Jill Jamieson-Nichols

A 93-year-old real estate

company expanded its Den-

ver metro holdings with two

office properties in the south-

east suburban submarket.

Melcor Developments Ari-

zona Inc. bought the Offices

at the Promenade and Office

Plaza at Inverness in separate

transactions totaling $26.45

million.

Offices at the Promenade is

a 128,400-square-foot property

at 7935 and 7995 E. Prentice

Ave. in the Denver Tech Cen-

ter. Felton Properties sold the

two buildings for $16.85 mil-

lion, or $131.23 per sf.

Office Plaza at Inverness

sold for $9.6 million, or

$102.89 per sf. It consists of

93,314 sf in three buildings at

6 Inverness Court East, and 8

and 10 Inverness Drive East in

Inverness Business Park.

“We’re very bullish on the

Denver market,” said Melcor

Vice President Darin Rayburn,

noting net migration, a young

demographic and light rail

lend to the region’s vibrancy.

Melcor owns 1,100 acres of

residential land in Aurora and

also owns the Centennial Air-

port Plaza office building. The

acquisitions give it a presence

in the southeast submarket’s

two major office nodes, Ray-

burn said.

“The Denver Tech Center is

a development that we covet,”

he said, adding Inverness also

offers a master-planned envi-

ronment. “We understand

the power of a good master-

planned community,” he said.

Melcor Developments is

affiliated with Edmonton,

Alberta, Canada-based Mel-

cor Developments Ltd., which

was founded in 1923 and

where Rayburn serves as exec-

utive vice president. Melcor

also has a Canadian real estate

investment trust, of which he

is CEO.

The company does its U.S.

business out of Scottsdale,

Arizona, and is a long-term,

hands-on owner. “We’re not

capital markets people. We’re

real estate people,” Rayburn

said.

There likelywill be improve-

ments to the company’s new-

est Denver properties, but

not before collecting feedback

from tenants.

Melcor has a third Denver-

area office property under con-

tract that’s expected to close

soon.

Both Offices at the Prom-

enade, and 6, 8 and 10

Inverness offer upside for the

new owner, according to bro-

kers involved in the deals.

At Offices at the Promenade,

“Market rents are about $23 a

square foot, and the average

rents in place are about $19.50,

so there’s a considerable

amount of upside potential in

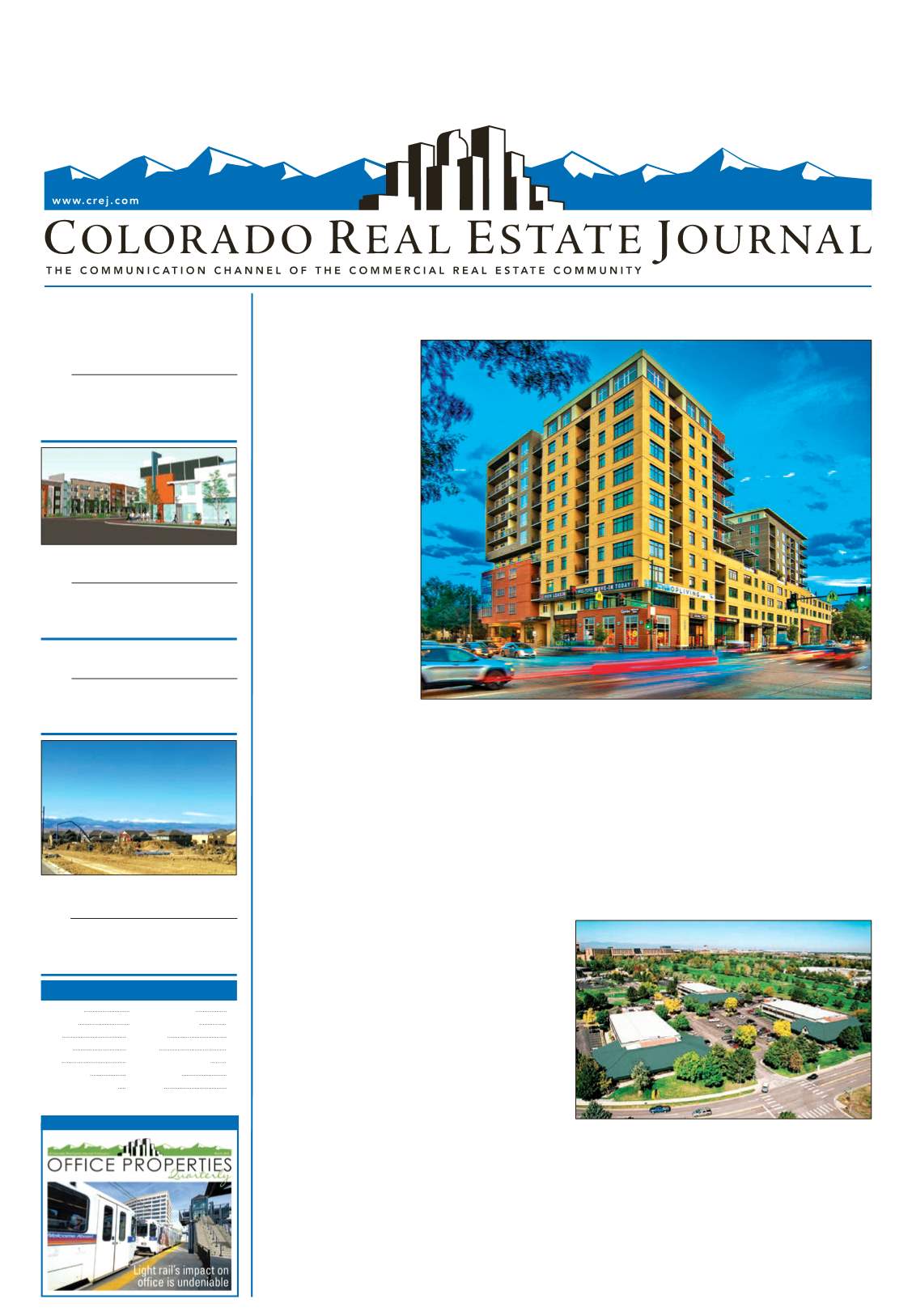

Office Plaza at Inverness, located at 6 Inverness Court East, and 8

and 10 Inverness Drive East, comprises 93,314 square feet.

CONTENTS

Inside