June 2016 — Health Care Properties Quarterly —

Page 11

MECHANICAL ADVISORS

YOU CAN TRUST

For healthcare facilities

construction and service.

As the region’s largest mechanical contractor,

RK Mechanical

understands the complex requirements of hospitals and medical

facilities. We partner with designers to optimize system designs

before installing HVAC, plumbing and hydronic systems. Plus, we have

the experience to keep your staff and patients safe—and keep your

facility operating—during major renovations.

Need facilities services once construction is complete? Call

RK Service

for HVAC, plumbing, electrical and water treatment solutions.

We’ll keep your facilities in excellent health.

Castle Rock Adventist Hospital, Castle Rock, CO

Advanced BIM and value engineering enabled RK to prefabricate 90% of the HVAC,

plumbing and piping before getting on the job site, saving time and money.

303.355.9696

MECHANICAL

SERVICE STEEL ENERGY WATER ELECTRICAL MISSION CRITICAL

Broker Insights

C

olorado’s commercial real

estate market has defi-

nitely had one unbelievable

rebound in the last few years

in all market sections: exist-

ing residential development and

sales; multifamily development;

retail development; and office

development in Denver, Boulder

and Fort Collins.

We have yet to see new spec office

buildings being built in Colorado

Springs, however, we have seen

some speculative industrial high-

cube space being built in the south

end of Colorado Springs.

Where do medical office buildings

stand?

There were several sales of

medical office buildings last year

and there are multiple MOBs on

the market presently in Colorado

Springs. Last year’s prices do not

correlate to this year’s prices. The

cap rates on the buildings sold last

year ranged from 6.75 percent up to

roughly 8 percent. Most of the prod-

ucts being offered now have occu-

pancy greater than 90 percent, with

some being 100 percent occupied.

Building owners are trying to sell

around a 6.5 percent cap rate and

there is not a lot of movement at

this particular point. Nothing that

I am aware of has traded hands.

The overall occupancy level on the

north end of Colorado Springs is

less than 12 percent. There are very

few large blocks of space for lease,

and the only place for a new tenant

to go would be a build to suit. The

rents, unfortunately, are not driving

up the price of new

buildings. Rental

rates for Class A

office space in

Colorado Springs

range between $14

and $22 per square

foot triple net, with

the majority of

these spaces being

second generation.

There is very little

shelf space avail-

able under 50,000

sf as of May.

For building own-

ers of MOBs to take

advantage of this

market cycle, cap

rates will need to

rise above 7 per-

cent. We have seen

a surge of purchas-

ers of ambulatory

surgery centers in

the Denver metro-

politan area. These,

of course, will sell

at less than a 7

percent cap rate

but typically have

seven-, 10- and

15-year leases in place.

For instance, in Colorado Springs

within the last two years, there

have been only two transactions of

MOBs between $5 million and $15

million that sold at a 7 percent cap

rate – 595 Chapel Hills Drive sold

for $8.7 million and 1633, 1625, 1644

Medical Center Point sold as a pack-

age deal for $26 million.

In Colorado Springs, very few of

the buildings being offered have

tenants that have signed new

10-year leases. Most are in the

middle of a 10-year lease and have

anywhere between three and five

years left. The good news is there is

going to continue to be a demand

for second- and third-tier medical

office buildings. Not everyone can

afford to be on campuses and the

large hospital systems do not want

everybody there. Until rental rates

consistently break $20 per sf, we

are not going to see construction

of new medical office buildings. If

you are an owner of a MOB, you can

take the money and run during this

cycle or take your chances on rene-

gotiating your tenants in a two- to

three-year period when their leases

are up.

s

Ted Link

Broker/owner,

Cascade

Commercial Group,

Colorado Springs

David Schroeder

Broker associate,

Cascade

Commercial Group,

Colorado Springs

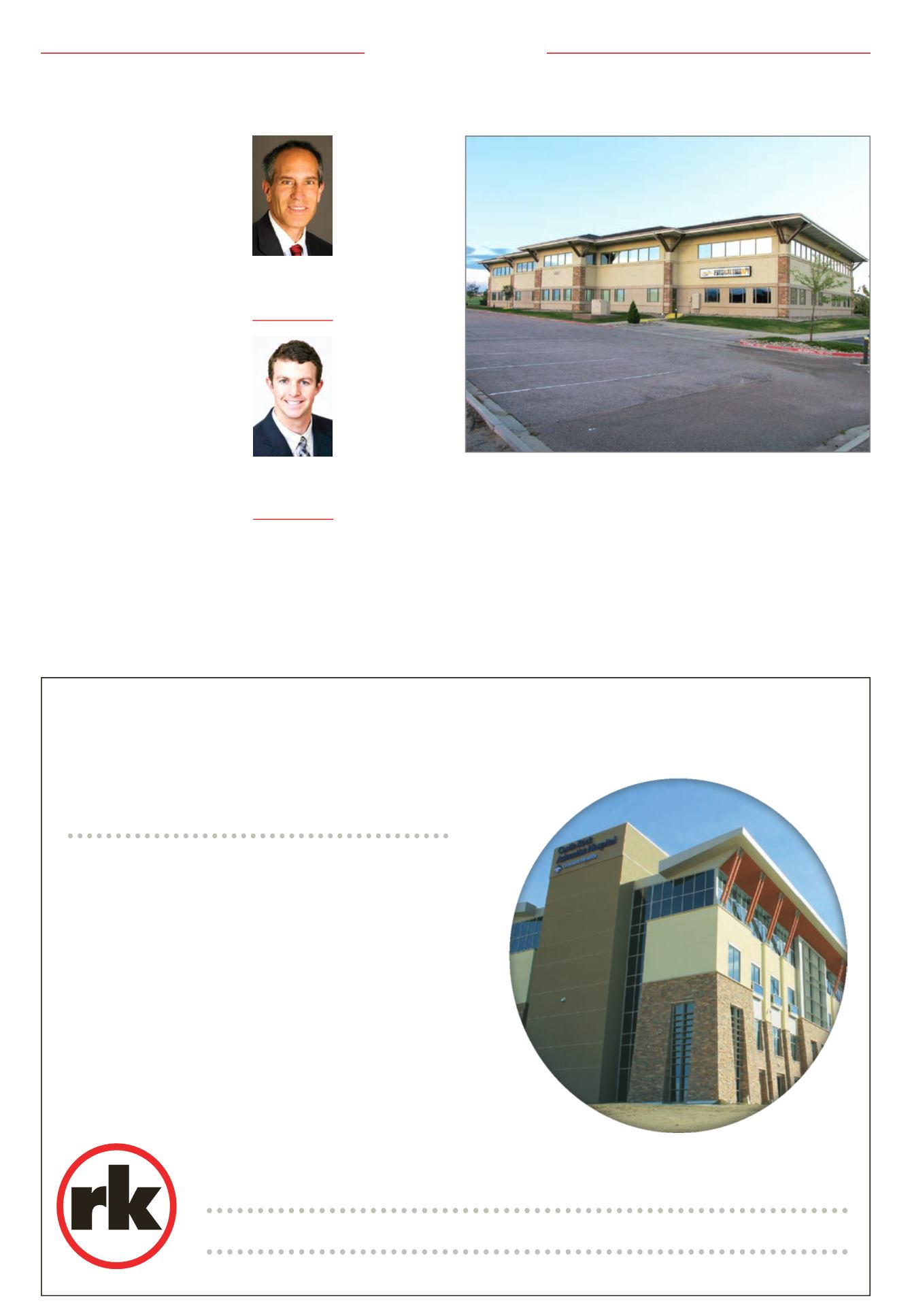

Powers Professional Campus II at 6160 Tutt Blvd., just south of the St. Francis Medical

Center North, has only two vacancies and is being marketed for sale.