Page 6

— Multifamily Properties Quarterly — July 2015

Prudential Mortgage Capital Company combines one of the

industry’s most experienced teams with extensive lending

capabilities and consistent performance in the Colorado market.

We originated $7 billion* in multifamily loans in 2014 and

focused on a variety of specialized property types including:

market rate housing, affordable housing, student housing, senior

housing and health care senior living. Once again, the numbers

prove it: We have the talent and resources to get your deal done.

PRUDENTIAL MORTGAGE CAPITAL COMPANY

WE GET IT.

DONE.

Prudential Mortgage Capital Company’s

loan programs include:

Fannie Mae DUS

TM

loans

Freddie Mac Program Plus

®

Specialized affordable housing programs

FHA

Conduit

Prudential’s life company portfolio and

proprietary balance sheet program

25”

T:7.25”

A

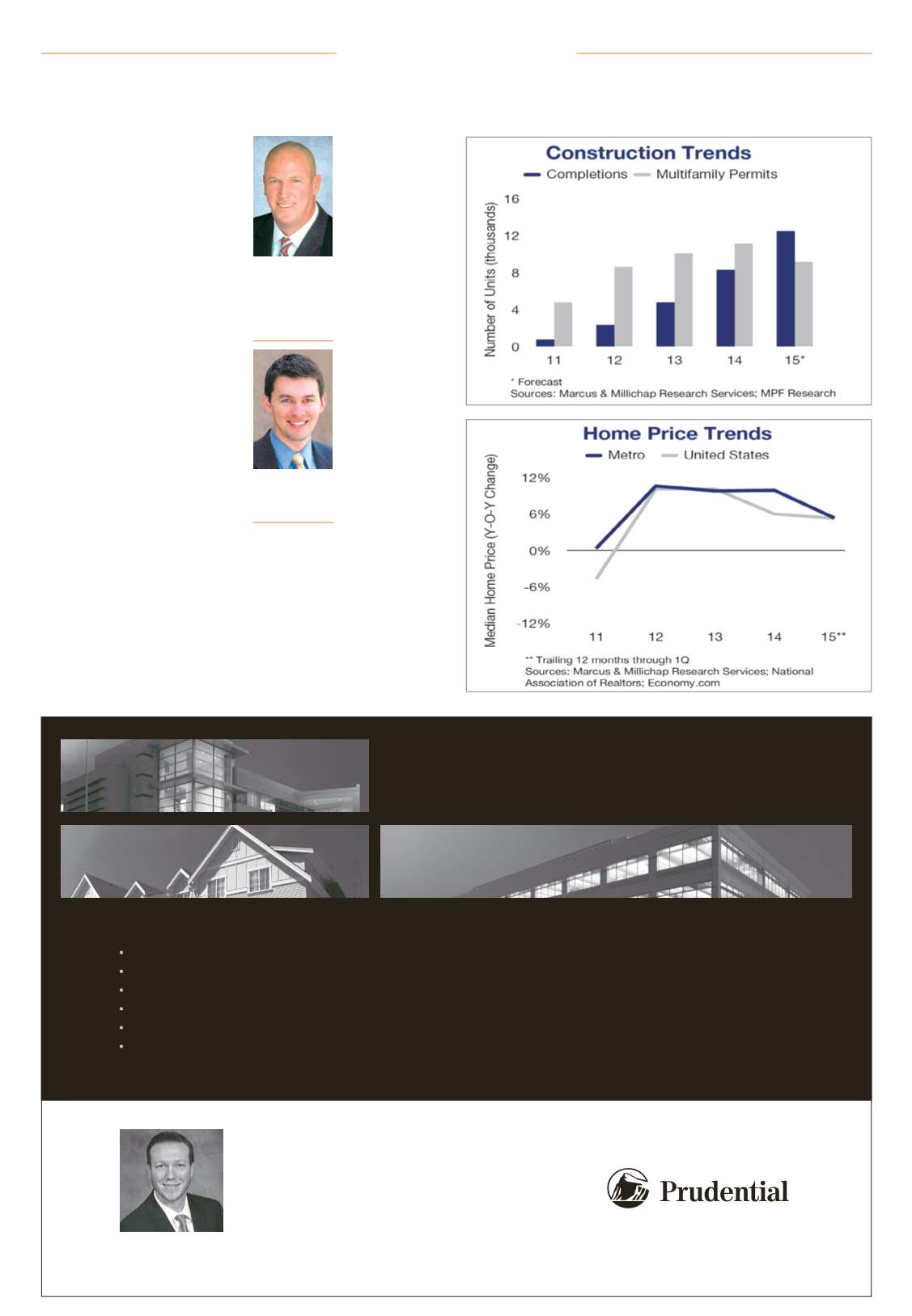

partment operators in Den-

ver will enjoy tight vacancy

and substantial rent growth

this year, despite an expand-

ing construction pipeline,

making the metro one of the stron-

gest apartment markets in the coun-

try. Development, poised to reach

the highest pace in more than 15

years, will pose potential headwinds,

especially for operators of Class A

apartments in the urban core where

many residents are looking for a

live-work-play environment. Several-

thousand rentals are slated to come

on line by the end of this year, and

some periodic increases in vacancy

will continue to ebb and flow as new

properties lease up. Overall, Denver’s

thriving economy will continue to

be a draw for young, educated work-

ers, providing an additional lift to

the apartment market. This year,

Denver’s 20- to 34-year-old cohort

will expand 1.6 percent, outpacing

the national average fourfold. Also,

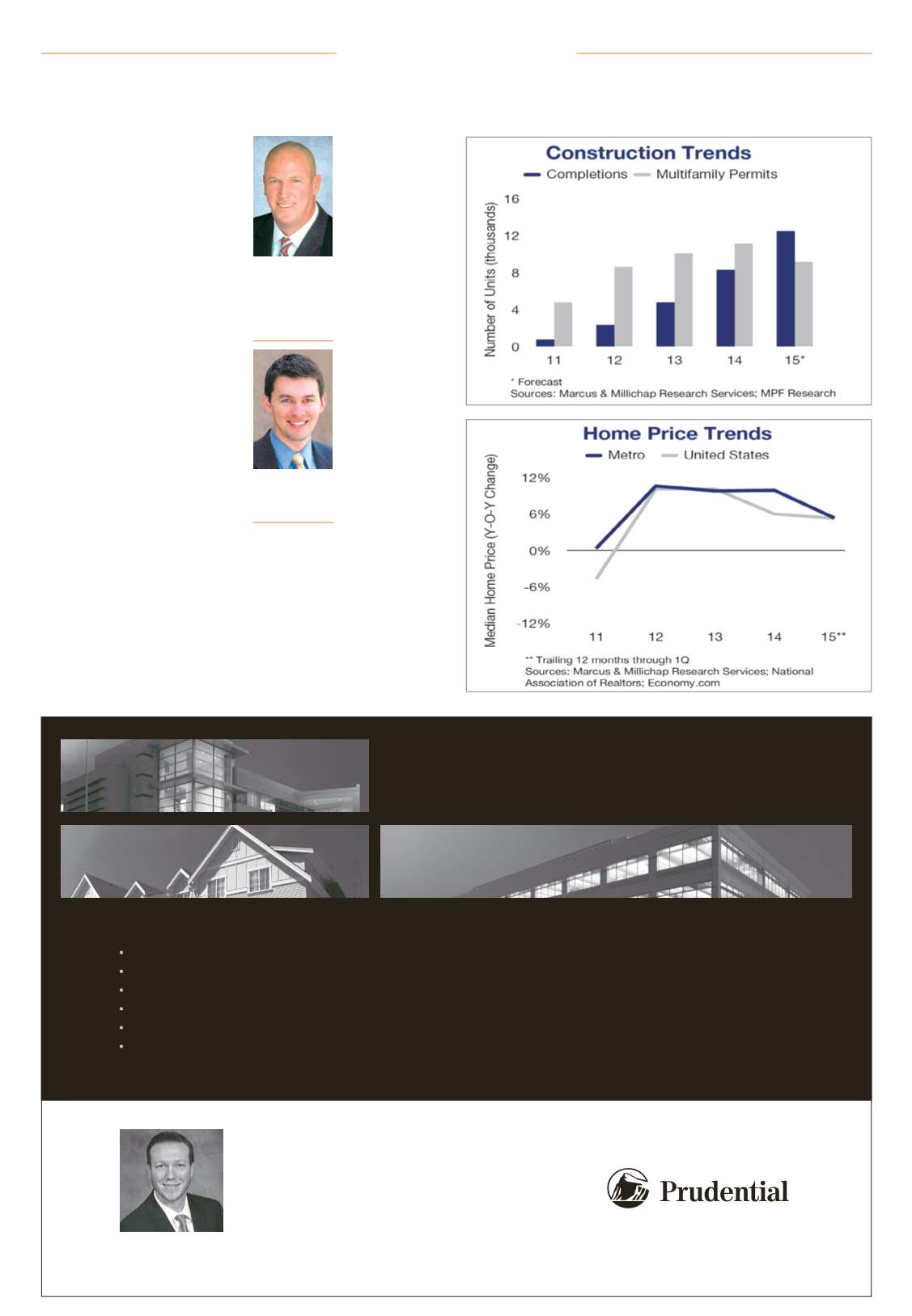

single-family housing remains unaf-

fordable to many, which will extend

the tenure of rental households.

Rising apartment demand will push

rental rates to grow at one of the

fastest paces in the nation.

The strengthening economy and

rising revenue streams are driving

up property incomes and increas-

ing apartment demand as a wide

array of investors compete for lim-

ited for-sale inventory. Buyers from

coastal markets, who are less price

sensitive, are searching for assets in

central Denver, pushing up prices

in the submarket. Elevated investor

demand in the northwest corridor

also caused a sharp rise in property

values. Higher prices in central Den-

ver and closer-in

submarkets are

driving many local

buyers from core

areas in central

Denver farther out

into the suburbs.

In the north Aurora

submarket, cap

rates for pre-1990s-

built apartments

can average in

the low-6 to low-7

percent range. By

contrast, similar

properties in cen-

tral Denver average

roughly 100 basis

points lower. Local

buyers who pre-

fer high first-year

returns are search-

ing in secondary

and tertiary cities

in Colorado and

burgeoning major

markets in other

states. Nonetheless,

real estate invest-

ment trusts and

institutional buyers

remain active, tar-

geting newer upper-tier properties in

central Denver and near the Denver

Tech Center, where cap rates can dip

below 5 percent.

Sales velocity accelerated 23 per-

cent for the past 12 months, ending

in the first quarter, as additional

capital flowed throughout the metro,

nearly doubling transaction volume.

The overwhelming majority of trans-

Greg Price

Vice president

investments,

director, National

Multi Housing

Group, Marcus &

Millichap, Denver

JD Lemon

Associate, Marcus

& Millichap,

Denver

Investment Market