Page 12

— Multifamily Properties Quarterly — July 2015

L

ast year, in recognition of

Colorado’s growing need for

affordable housing, and to

respond to the need for more

housing in Northern Colorado

following the 2013 floods, the Colo-

rado General Assembly took a bold

step in renewing Colorado’s Low

Income Housing Tax Credit program.

Modeled after the successful federal

LIHTC program, state tax credits are

used to incentivize private sector

investment in the development of

affordable rental housing. Since its

creation in 1986, the federal LIHTC

program supported the development

or preservation of 46,000 affordable

multifamily units across Colorado.

In only one year, the newly renewed

state LIHTC program is making a

significant positive impact in Colo-

rado’s housing landscape.

State and federal tax credits are

allocated to affordable housing

developers by the Colorado Housing

and Finance Authority. Developers

who are awarded tax credits sell

them to investors to raise equity

for the development of multifamily

properties. LIHTC-supported proper-

ties are targeted to serve low-income

households, and many serve the

state’s most vulnerable populations,

including seniors, veterans and the

homeless. The tax credits serve a

critical role in helping generate suf-

ficient up-front equity to allow a

development to proceed with signifi-

cantly less debt financing. This equi-

ty enables the property to operate

successfully despite having reduced

cash flow, given the rent restrictions

designed to ensure that residents

only pay 30 percent of their income

toward rent.

In order to

ensure that the

new state LIHTC

was deployed as

efficiently as pos-

sible, CHFA lever-

aged it with federal

LIHTC. The results

are significant. As

of June, by com-

bining state and

federal tax credits,

CHFA already has

supported 1,802

units, with one

more round of tax

credit allocation to

be conducted later this year. CHFA

estimates 3,000 affordable rental

housing units will be supported with

LIHTC by year end, an increase of

nearly 90 percent compared with

the most recent five-year average of

units supported annually.

State LIHTC recipients in 2015

include for-profit and nonprofit

developers, as well as housing

authorities. Every development

receiving 2015 state tax credits is

located in an area where vacancy

rates are below 5 percent. Many of

the developments supported with

state LIHTC are located in the coun-

ties most impacted by the 2013

floods. These communities already

suffered tight rental housing mar-

kets, which were then exacerbated

by the loss of housing due to the

floods. To most effectively address

this affordable rental housing need,

CHFA partnered with the Colorado

Division of Housing to jointly review

applications and select projects to

receive tax credits and Community

Development Block Grant-Disaster

Recovery funds.

The following developments were

awarded state LIHTC in CHFA’s

first allocation round completed in

March:

Ash Street Apartments, Denver.

Sponsored by Mile High Develop-

ment and Koelbel and Co., Ash

Street Apartments is a 112-unit

project serving workforce individu-

als and families, and located at the

redevelopment site of the former

University of Colorado Health and

Sciences Center.

Broadway Station Lofts, Englewood.

Sponsored by Medici Communities,

Broadway Station Lofts is a 111-unit

project serving individuals and fami-

lies, and located on South Broadway

in the heart of downtown Engle-

wood.

Montbello VOA Elderly Housing II,

Denver.

Sponsored by Volunteers

of America, Montbello VOA Elderly

Housing II is an 86-unit project serv-

ing seniors in northeast Denver.

13th Avenue Apartments II, Aurora.

Sponsored by Solvera Developers,

13th Avenue Apartments II is a 177-

unit project serving individuals and

families, and located on the south-

ern boundary of the Anschutz Medi-

cal Campus and the Fitzsimons Life

Science District.

Steve Johnson

Community

development

director, Colorado

Housing and

Finance Authority,

Denver

Taxes

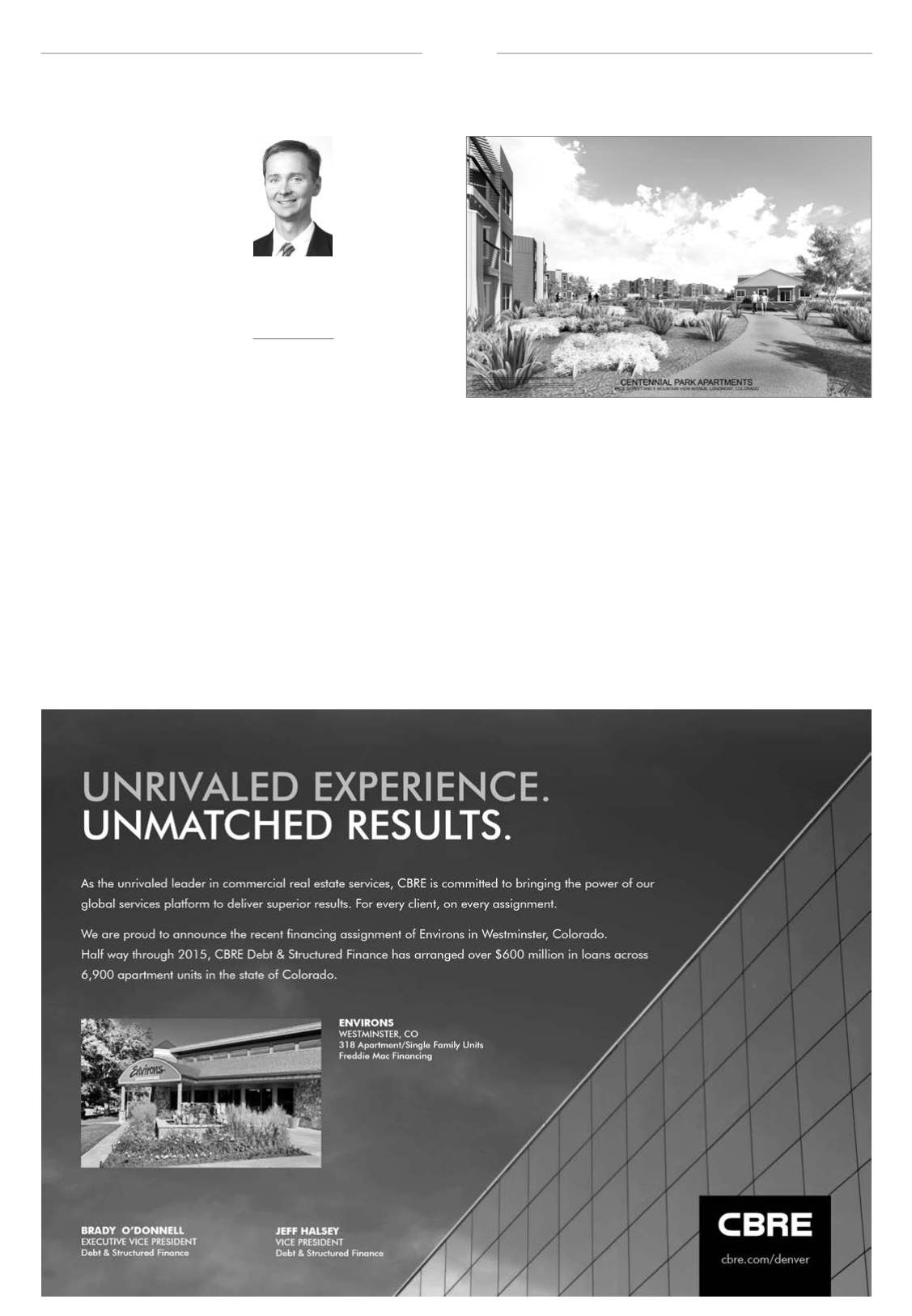

Centennial Park Apartments in Longmont is one of many Colorado communities award-

ed a low-income housing tax credit.