Page 20

— Multifamily Properties Quarterly — July 2015

Market Driver

Y

ou have probably read many

articles in the Colorado Real

Estate Journal praising the

strength of Denver’s mul-

tifamily market. However,

with 20,000 units currently under

construction and another 20,000

in planning, there have been rum-

blings of oversup-

ply on the horizon.

Approximately

9,000 units were

delivered in 2014

and another 10,000

are expected in

2015. Those deliv-

eries come with

record net absorp-

tion numbers

– 7,325 trailing

12-month annual

absorption in

first-quarter 2015,

topping the previ-

ous record of 7,100

in fourth-quarter

2014. This is well

above the 3,250

average absorbed

over the last 10

years, accord-

ing to Apartment

Insights.

Despite the

record absorption

numbers, multi-

family develop-

ers may finally be reacting to the

abundance of projects in the pipe-

line; trailing 12 month multifam-

ily permits for metro Denver have

declined each of the last two years,

from 8,357 units in April 2013 to

7,711 units in April 2015. Denver’s

effective rent growth of nearly 12

percent in 2014 ranked No. 3 in the

nation, and almost halfway through

2015, Denver is holding the No. 3

spot with an annual effective rent

growth of 11 percent. For a market

that historically averaged 3 percent

rent growth, the recent rent gains

are nothing short of remarkable.

Still, with the number of units in

the pipeline, and permitting above

historical averages, multifamily

investors are begging the question,

“Are we building too much hous-

ing?”

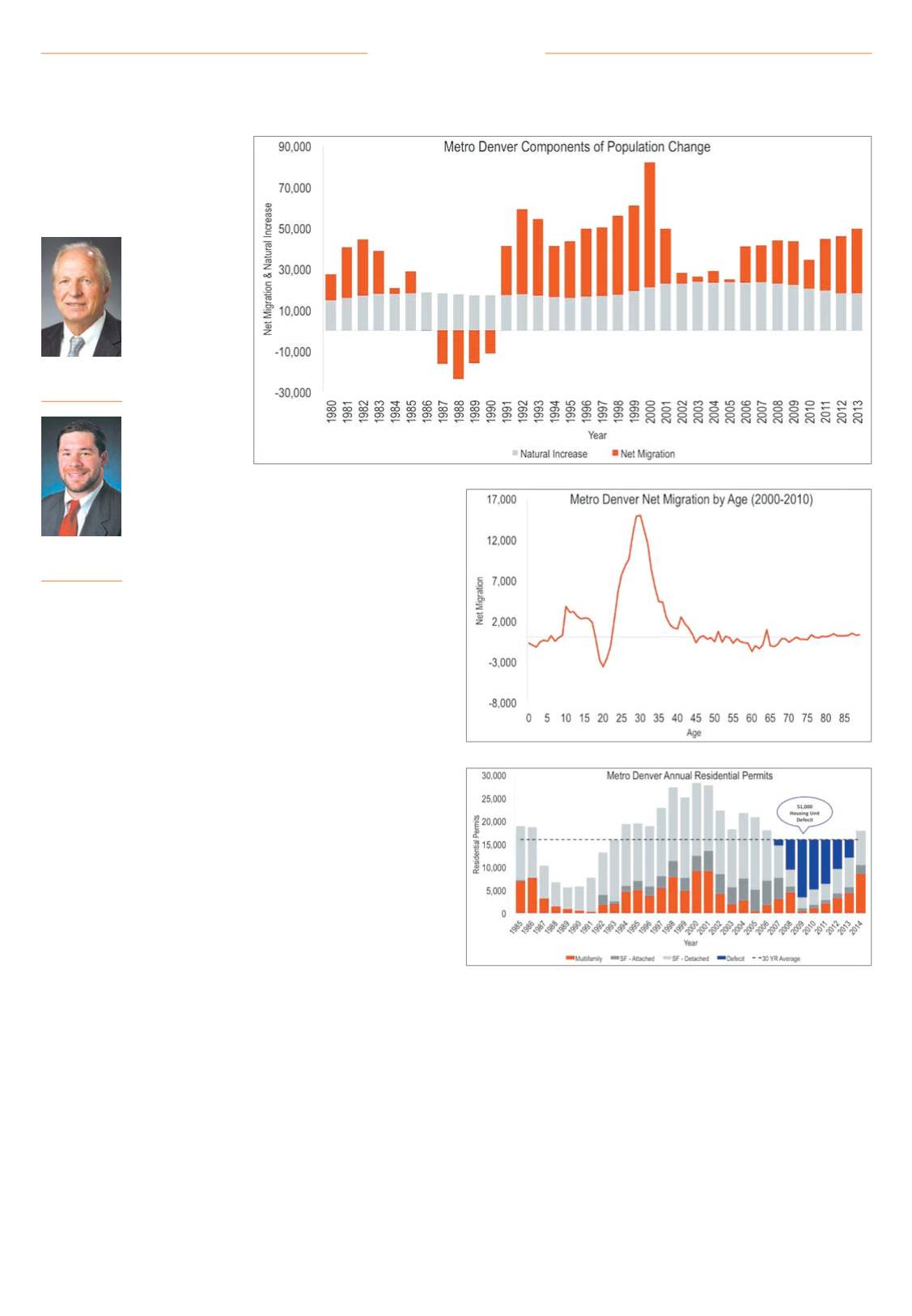

While multifamily permitting

for the metro area has started to

decline, it still stands at more than

double the 30-year average of 3,700

units. However, if we widen our

lens, we see some interesting trends

in the overall housing market. It is

not just rent growth – Denver leads

the nation in home price apprecia-

tion as well. The Mile High City is in

high demand. So, we would expect

to see the same permitting trends

for single-family housing, right?

Not the case. Over the last eight

years, permitting for single-family

detached homes has been below

the 30-year average of 10,000. Those

eight years represent the time fol-

lowing the housing boom’s peak.

However, Denver was not hit nearly

as hard as other metros during the

bust, and it is one of the few metros

where values have surpassed the

peak achieved during the boom.

Considering this, it is not entirely

clear that the question of “too much

housing” is the correct question to

ask.

Going back 30 years, when

accounting for single-family

detached, single-family attached

and multifamily housing, Denver

averaged about 16,000 total hous-

ing units per year. Last year was the

first year since the housing peak

that we permitted a number that

high. In the seven years leading

up to 2014, we permitted roughly

61,000 units. Using the annual his-

torical average of 16,000 as a bench-

mark, we would expect 112,000 per-

mits during that timeframe, which

would leave a deficit of 51,000. Over

that time, the homeownership rate

in Denver plunged from 70 percent

to 55 percent, according to the U.S.

Census 2015 first-quarter report.

That gives Denver the seventh-low-

est homeownership rate among the

75 largest metros. The low home-

ownership rate, however, is not for a

lack of effort on the part of would-

be homeowners. According to the

same U.S. Census report, Denver

had the fourth-lowest homeowner

vacancy rate at 0.3 percent. People

want homes – there simply aren’t

any available.

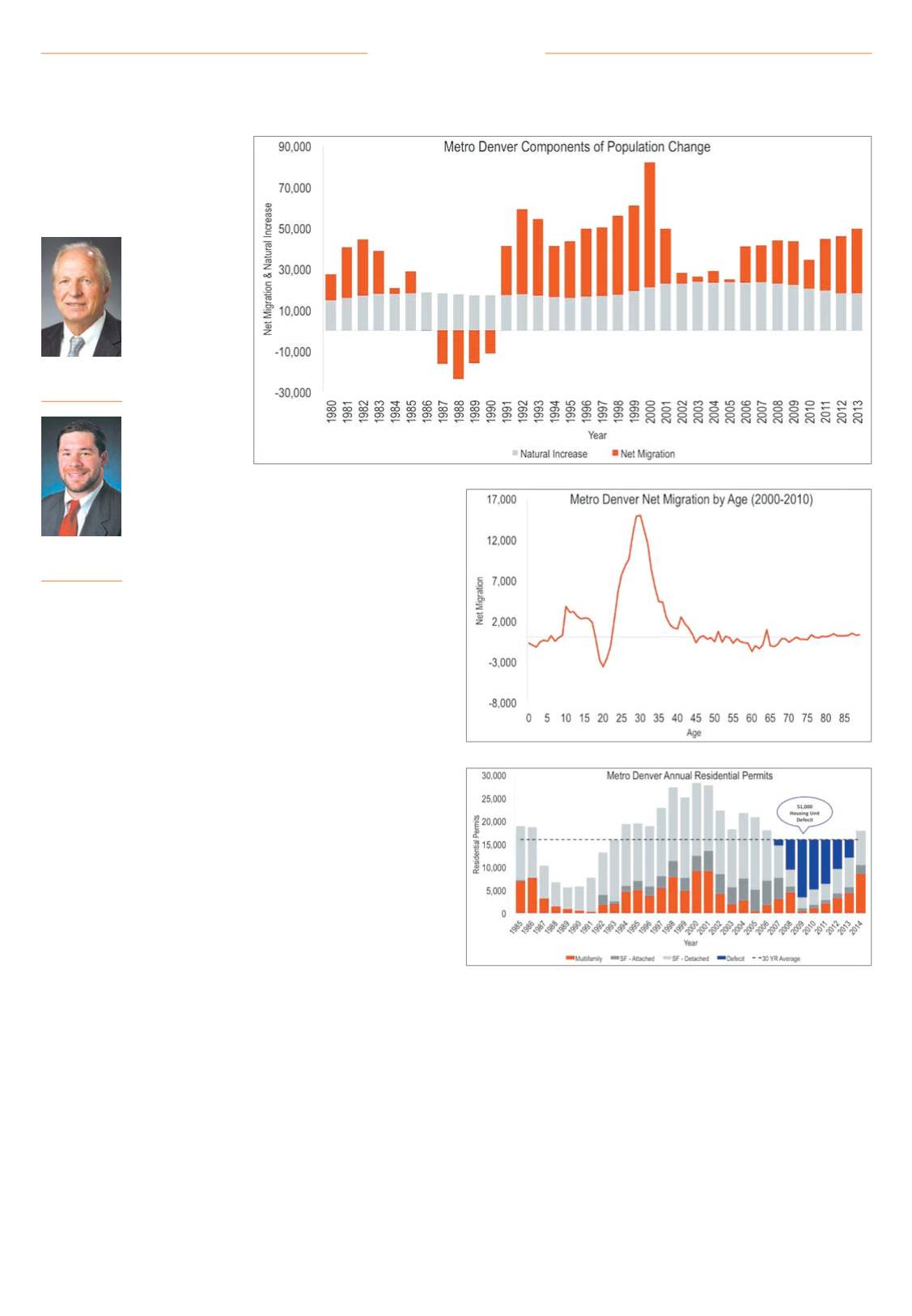

In the years after the housing

boom’s peak, an interesting thing

happened – Denver’s population

grew by 375,000, an annual rate of

1.7 percent, due in large part by net

in-migration. Population growth

in the metro area is expected to

stay in the 1.6 to 1.7 percent range

through 2020, which is double the

projected rate for the entire U.S. (0.8

percent).

The millennials, of course,

account for a significant portion

of the people moving to Denver.

According to the Colorado Depart-

ment of Local Affairs, with a popu-

lation of 730,000 millennials, they

are now the largest population

group in metro Denver, easily top-

ping generation X and the baby

boomers. Over the next 10 years,

that gap is expected to widen as

Colorado’s State Demography Office

projects millennial net in-migration

at an annual clip of 11,000. It is dif-

ficult to predict where all of these

millennials will live, but according

to a recent study from Urban Land

Institute, only 26 percent of mil-

lennials in the U.S. currently own a

home.

Millennial housing patterns have

become a popular topic, and many

experts believe millennials possess

a lack of desire for homeownership.

According to the same ULI study,

21 percent of millennials nation-

wide still live with their parents

or other relatives. Extrapolate that

percentage for Denver’s millennial

population, and you would have

over 150,000 still living with fam-

ily members. Considering Denver’s

permitting trends after the peak

(2007-2013), our estimated deficit

of 51,000 units, which is below the

historical average, could lead one to

believe the number of millennials

living with relatives is even higher.

The natural progression from liv-

ing with relatives is moving into a

rental.

Even if there were a desire to

own, Denver has very few options.

The median price of homes sold

in Denver is over $311,000 while

median millennial earnings fall

short of $40,000, according to the

Metro Denver Economic Develop-

ment Corp., putting homeowner-

ship out of reach. The U.S. Census

showed Denver as having the larg-

est increase in residents with col-

lege degrees, but for many, getting

a degree means incurring student

debt. Nearly half of millenni-

als nationwide have student debt

averaging $27,000 per person. With

home price appreciation outpacing

wage growth, it may take some time

before millennials can afford to buy

a home in Denver.

There are two issues making mat-

ters worse – the short supply of lots

available for single-family develop-

ment, and a lack of any measurable

condominium development. The

overall rising real estate market

in Denver has boosted land values

across the board, making low-densi-

ty single-family homes at affordable

prices for first-time buyers difficult

to develop. Condo construction is

missing from the equation entirely

due to Colorado’s construction-

defect law.

So, it seems the question we

should be asking is, “Are we build-

ing enough housing?”

s

Pat Stucker

Managing director,

JLL, Denver

Travis Hodge

Associate, JLL,

Denver

Charts courtesy: JLL