Page 22

— Multifamily Properties Quarterly — July 2015

Market Driver

I

t would be an understatement to

say that these are good times for

the apartment industry. For most

in the industry, they are probably

the best in their lives.

Capital is abundant and growing

demand is outpacing increases in sup-

ply even as new units come on line.

And there’s reason to believe there is a

significant amount of pent-up demand

still to come into the market.

To the outside world, though, it

all consolidates into one conclusion

– rents are rising. Metro area rents

were up 13 percent year over year as

of April, according to the Apartment

Association of Metro Denver.We have

seen the headlines around the coun-

try and locally about double-digit rent

growth.

Our success makes us easy targets

for inclusionary zoning or rent-control

proposals championed often by well-

intentioned advocates seeking to

address the affordability gap.They hear

about rising rents and want a solution,

often unaware of the real costs and

unintended consequences of many of

these so-called easy and no- or low-

cost solutions – namely, even higher

rents and less supply.

So, how should we, as an industry, be

talking about rents and affordability?

First, today’s strong rent growth is a

temporary situation in what is a highly

cyclical market, driven by factors large-

ly outside of the industry’s control.The

collapse of the U.S. financial markets

in 2008 virtually shut down new apart-

ment construction for several years,

severely constricting supply at a time

when rental demand was about to

surge.

Second, apartment construction is

ramping up. As those units are deliv-

ered, rent growth will moderate. But

even with more apartments in the

pipeline, construc-

tion activity remains

below the level

needed to meet ris-

ing demand.

Many nonfinancial

obstacles to new

development, such

as unnecessary and

duplicative regula-

tions, outdated

zoning policies and

not-in-my-backyard

opposition to apart-

ments, continue to

stifle new construc-

tion and raise the

costs of the prop-

erties that are built, contributing to

higher rents for our residents.

Third – and this may be the most

important fact – America’s affordable

housing shortage is more than just a

housing problem. It is not only the fact

that rental housing is more expensive

to produce and operate, but also there

are other economic factors that have

suppressed household income growth.

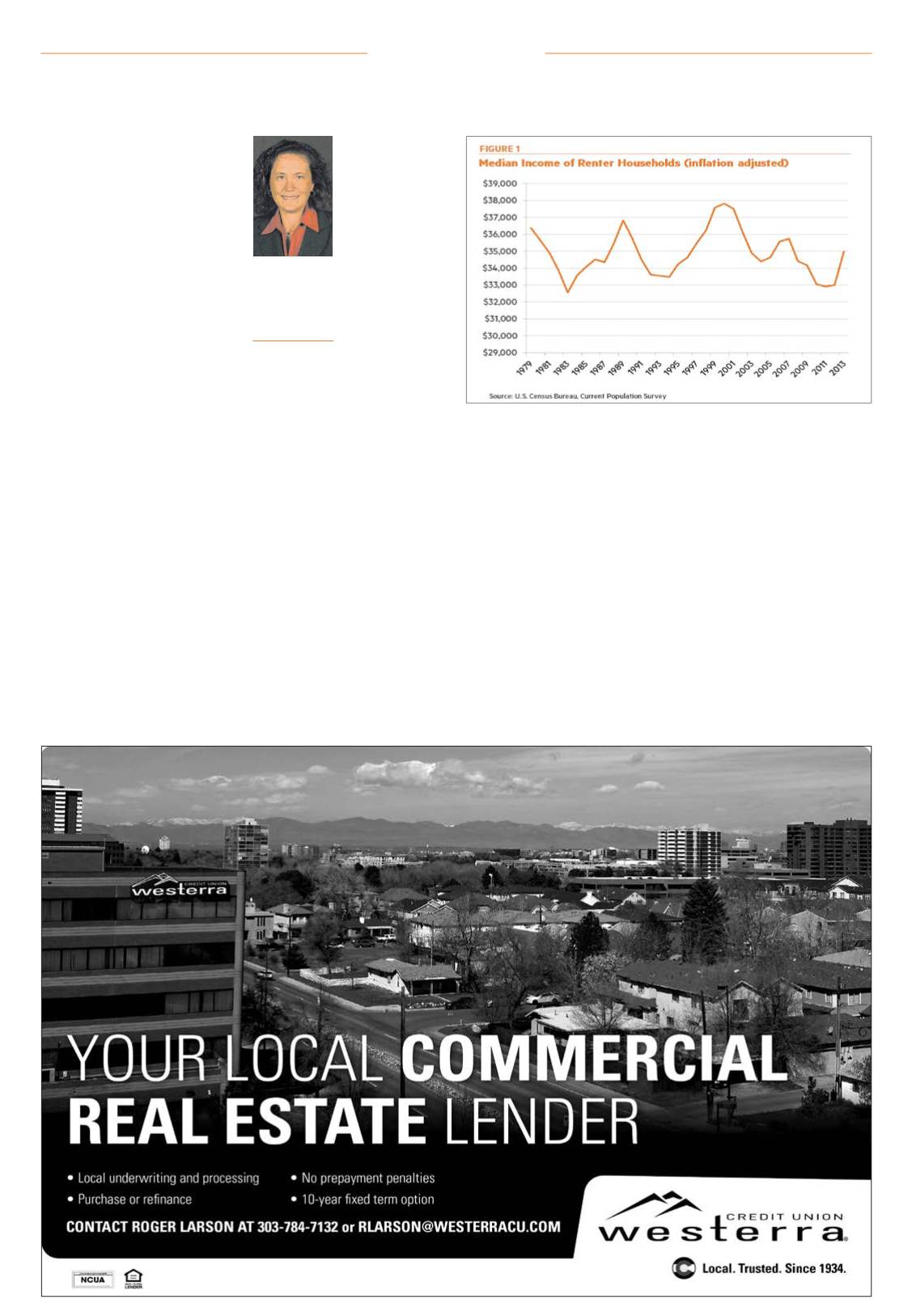

Housing affordability is really about

housing costs in relation to income.

On an inflation-adjusted basis, median

renter household income today is

virtually the same as it was in 1981.

Because income stagnation is such

a large part of the equation, we sim-

ply cannot build our way out of this

affordable housing shortage. In fact,

in many markets where demand is

strongest, even if, hypothetically, devel-

opers agreed to take no profit, the cost

to build still exceeds what people can

afford to pay.

In addition, housing affordability is

an issue for homeowners (and would-

be homeowners) as much as it is for

renters.This is often overlooked by

media who spotlight rising rents, but

cheer rising house values.

When we compare Denver renter

and owner affordability by income cat-

egories (so that similar households are

compared), we find strikingly similar

affordability burdens for each group.

For example, if we compare renter

households and owner households

earning 80 to 99 percent of area medi-

an income, we find that 33 percent of

renters are paying more than 30 per-

cent of their income (U.S. Department

of Housing and Urban Development’s

benchmark for cost-burdened house-

holds) and 31 percent of owners are

doing the same.This pattern, as shown

in the chart, reinforces the notion that

our housing affordability issues are not

just a renter issue.

A long-term solution to rising rents

requires meaningful income growth

and the removal of many barriers to

apartment construction. State and

local governments have a number of

tools available, and the federal Section

8 voucher program could also be better

leveraged to address today’s affordabil-

ity issues.The preservation of existing

affordable housing also is critical. By

finding ways to keep more properties

as a viable part of the overall apart-

ment stock for longer, we can add to

the available supply of housing, thus

reducing the pressure on rents.

This is the message the National

Multifamily Housing Council is taking

to policymakers at all levels. And it’s

one we hope apartment firms will help

spread as they talk to reporters as well

as state and local officials.

Through the use of advertising tools,

national, state and metro area eco-

nomic impact data, and the creation

of an interactive apartment economic

impact calculator at weareapartments.

org, renters and industry professionals

are educated and remain current on

the multifamily housing market.

s

Kim Duty

Senior vice

president, public

affairs, National

Multifamily

Housing Council,

Denver