Page 28

— Multifamily Properties Quarterly — November 2016

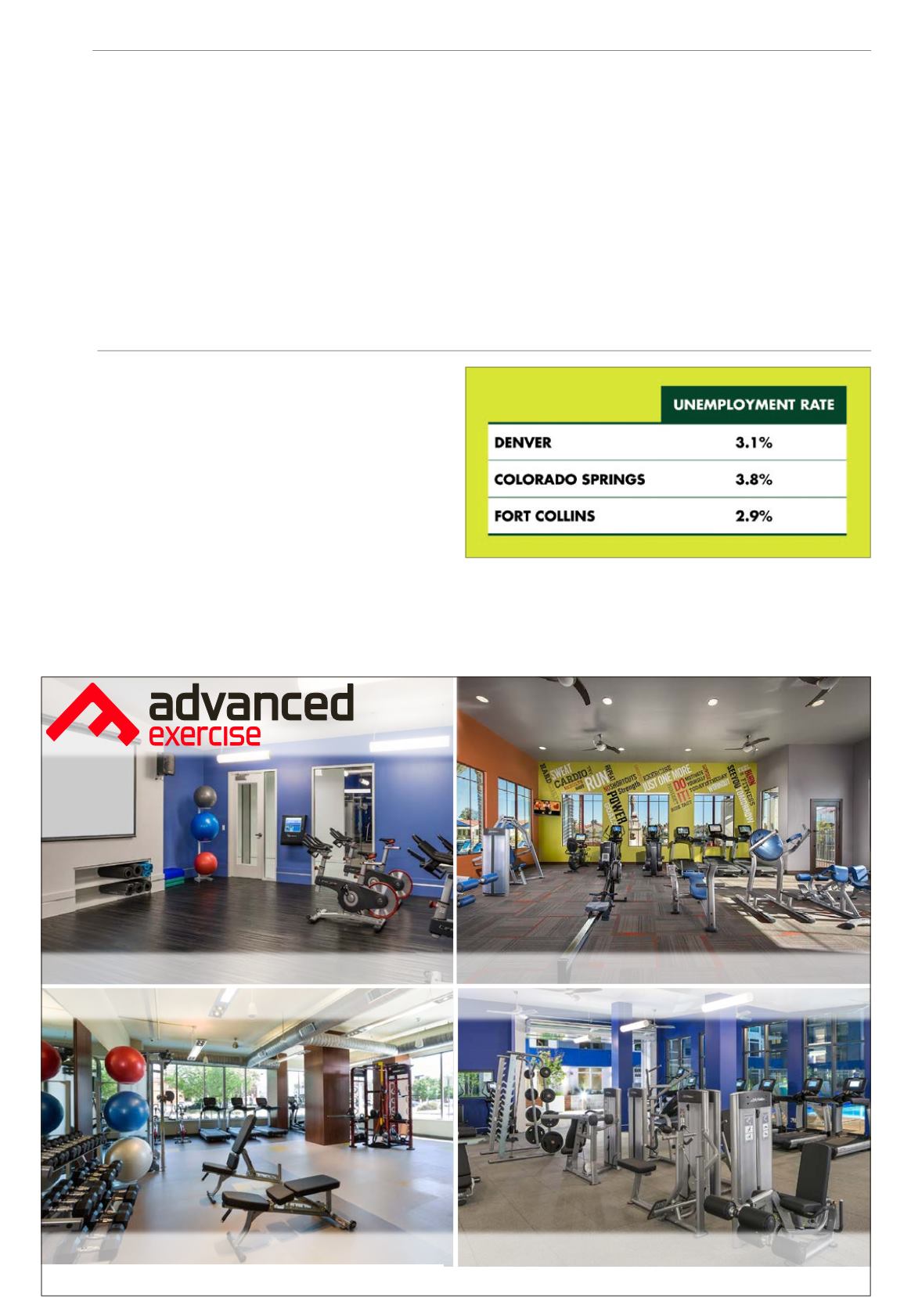

Your Local Fitness Design Consultant:

Jody Huddleson | 720.935.5059 |

jhuddleson@advancedexercise.comBeyond

“State-of-the-Art”

aware of the issue and is attempt-

ing to address it, at least in part,

with a recent linkage fee. While

money from the fee will go toward

affordable housing initiatives, it also

will increase the cost of apartment

construction by $1.50 per square

foot. City officials say this revenue

stream will subsidize the building of

about 6,000 housing units over the

next 10 years.

• Tightening lending industry and

rising costs.

Which brings us to the

pipeline. A tightening in the lending

industry and the lack of available

construction debt for the multifam-

ily industry indicates that of the

25,717 units currently in planning

phases, we will see significantly less

come to fruition.

After several years where multi-

family loans were cheaper and eas-

ier to come by, the lending industry

now is more closely monitoring its

exposure to the multifamily market.

Developers have to put more equi-

ty down at higher rates with less

favorable terms, so deals are becom-

ing less financially viable. Combine

that with the increased cost to build

right now, and it becomes difficult

to see all of those 25,717 units get-

ting built.

The multifamily industry is doing

its part, but the coming slowdown

in the apartment pipeline, the lack

of attainable options coming on line

and the growing population has the

potential to create a housing short-

age in the city.

• Putting everything in perspective.

All that said, Denver still is techni-

cally affordable. Stay with me here.

The generally accepted federal

measurement of housing afford-

ability looks at the ratio of rent to

income. No more than a third of

median family income should go to

housing.

Right now in the seven county

Denver metro area, the average

apartment rent to median family

income ratio is 20.5 percent, accord-

ing to Apartment Insights. So while

rents have certainly gone up in

recent years, Denver is still afford-

able compared to other major cities.

And that’s something else we’ve

become – a major city. Denver used

to be considered a secondary or

tertiary market, but we’ve moved

up. We’re now compared to some of

the bigger markets and, when com-

pared to those, we’re still relatively

affordable.

Over the next year or two, we may

deliver more units than we can

immediately absorb, but the under-

lying fundamentals in Denver – lots

of young in-migration and great

job growth – point toward a need

for more and a greater diversity of

housing options if we’re going to

keep pace with our growth in the

not-too-distant future.

s

In response to recent and pro-

jected growth, the region already is

investing billions into infrastructure

improvements designed to make

public transportation more widely

available. The recently completed

FasTracks light and commuter rail

has streamlined travel between Den-

ver and adjacent submarkets. Like-

wise, ongoing highway improvement

initiatives and upgrades to Denver

International Airport are expected

to enhance accessibility across the

region as local populations continue

to skyrocket.

Investors looking forward to 2017

have reason to remain optimistic.

While fluctuations in interest rates

and development costs may influ-

ence construction in the short term,

a bevy of positive factors like strong

population growth, high quality of

life and a young, highly educated

workforce suggest that opportuni-

ties for multifamily development in

the Denver metro area will remain

plentiful. Despite surface impres-

sions, multifamily experts are not

concerned about overbuilding. As

the short-term construction pipeline

becomes exhausted and construc-

tion lending tightens, development

will slow to a steady – rather than

breakneck – pace that will match the

demands from current and future

renter pools.

Keep an eye out for investors,

domestic and foreign, looking to tran-

sition away from well-established,

coastal markets and reinvest capital

in more cost-effective markets like

Denver. A large workforce comprised

of highly desirable talent and a loca-

tion central to both the East andWest

coasts has turned the Denver metro

area and surrounding markets into

hotspots for investors in search of

strategic, high-yield assets.

s

White

Young

Continued from Page 4 Continued from Page 12CBRE