Page 16

— Office Properties Quarterly — April 2015

C

olorado maintained its ranking

as a top 10 state for employ-

ment growth during 2014 and

is expected to post a strong 2.7

percent increase in employ-

ment in 2015.The employment base is

expected to reach 2.5 million workers

in 2015, representing the addition of

over 66,000 jobs.

More than 60 percent of employ-

ment in Colorado is located in the

seven-county metro Denver region.

Metro Denver job gains accelerated

during 2014, finishing out the year

stronger than expected with the addi-

tion of 46,200 jobs. An additional 45,000

jobs are expected to be added in 2015,

representing a 3 percent growth rate.

Metro Denver will experience particu-

larly strong employment growth in the

education and health care services,

professional and business services, and

leisure and hospitality supersectors.

About 120,000 workers were located

in downtown Denver during the first

half of 2014, based on the boundaries

defined by the 2007 Downtown Area

Plan. Using data from CoStar Realty

Information, this region includes about

20 percent of all office space in metro

Denver, or about 35.1 million square

feet. Employment data often is dis-

cussed in terms of 11 supersectors, or

combinations of employment sectors.

To simplify the discussion, employ-

ment in downtown Denver has been

further combined into six categories.

When viewed in this manner, a pic-

ture of the major users of office space

begins to emerge.

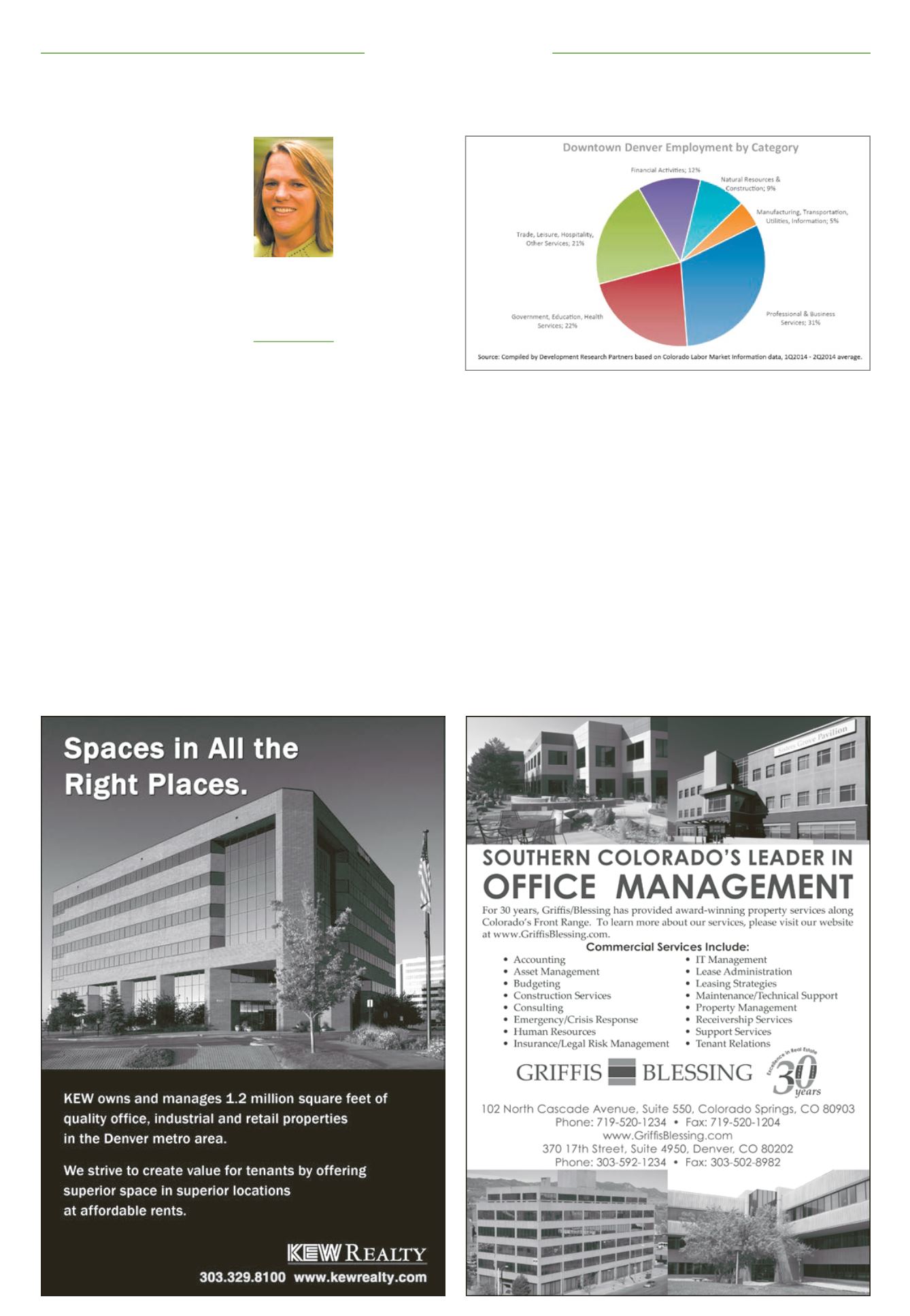

Nearly one-third of downtown Den-

ver’s employment falls in the profes-

sional and business services category.

This category includes the whole array

of business services, such as legal,

accounting, archi-

tecture, engineering,

computer systems

programming and

design, business

administration and

management, and

advertising.These

companies tend to

be office users, so

the expected strong

growth in this super-

sector bodes well

for downtown office

occupancy.

About 22 percent

of downtown Den-

ver’s employment

consists of federal, state and local

government workers, as well as educa-

tion and health care providers.This

category is also a large user of office-

type space in the central business area,

although much of the space occupied

by these workers is in landmark build-

ings such as the Colorado State Capitol

and the Denver City & County Build-

ing. Sustained economic growth and

increases in tax collections provide a

positive outlook for employment in this

category in 2015.

The third-largest category, represent-

ing 21 percent of the employment base,

includes all of the retail, leisure and

hospitality workers.These workers are

found in the hotels, museums and per-

forming arts spaces, as well as the 3.3

million sf of retail space in downtown

Denver. Only about 4.4 percent of the

downtown retail space was vacant at

the end of 2014. Leisure and hospital-

ity also is expected to be one of the

fastest-growing supersectors in metro

Denver in 2015, so downtown Denver

employment in this category should

remain robust.

The remaining roughly one-quarter

of the workers fall into three categories:

financial activities (12 percent), natural

resources and construction (9 percent),

and information, transportation and

utilities (5 percent).

Financial activities consist of banking

and finance, insurance, investments

and real estate.These office users

have experienced mixed results with

generally decreasing employment in

metro Denver’s banks, but increasing

employment in investment services.

About 60 percent of investment ser-

vices employment in metro Denver is

located in Denver and Arapahoe coun-

ties, with much of the Denver employ-

ment found in the Cherry Creek area.

Based on these mixed trends, minimal

change in financial activities employ-

ment in downtown Denver is expected.

About 78 percent of the natural

resources and construction employ-

ment in downtown Denver comes from

oil and gas companies, which tend to

occupy office space. Although the natu-

ral resources sector represents just 1

percent of metro Denver employment,

direct oil and gas employment rep-

resents about 7 percent of the down-

town Denver employment base, or

about 8,300 workers. As oil prices have

plunged from $106 per barrel in June

2014 to $47 in January 2015, oil and gas

companies are responding by decreas-

ing exploration and extraction activ-

ity. Depending on how long oil prices

remain low, a decline in oil and gas

employment in downtown is likely.

The smallest employment category

in downtown Denver, representing

about 5 percent of total employment,

consists of manufacturing, transporta-

tion, warehousing, utilities and infor-

mation companies. Information was

Employment growth and the downtown marketPatricia

Silverstein

President and

chief economist,

Development

Research Partners,

Littleton

Market Drivers

Please see ‘Employment,’ Page 30