MAY 18-MAY 31, 2016

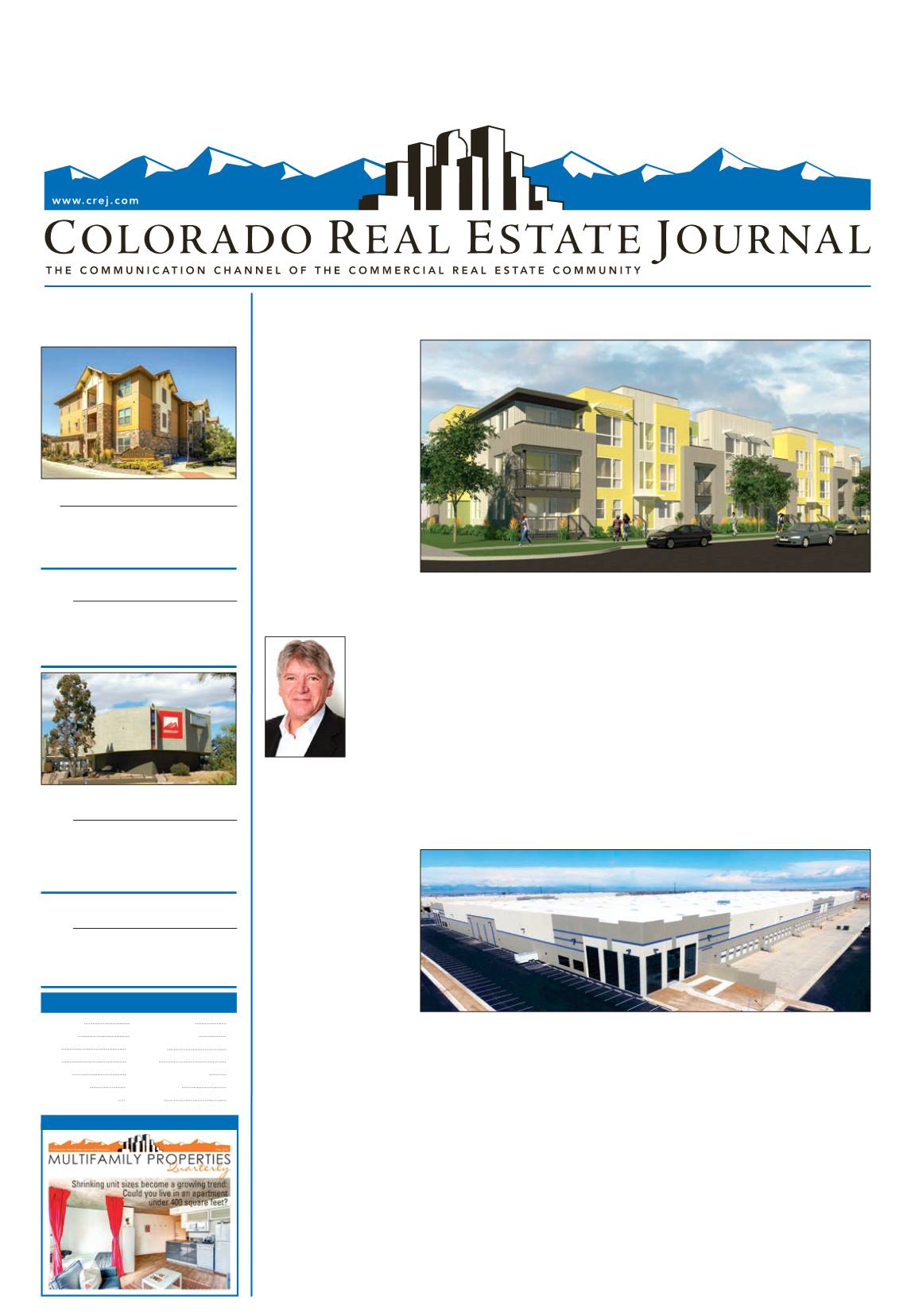

by John Rebchook

SteelWave, a new company

with a long history, is making

its multifamily development

debut in the Denver area with

a $100 million apartment

community in Aurora.

SteelWave, formerly Lega-

cy Partners Commercial, has

purchased 15 acres adjacent

to the Iliff light-rail station,

where it plans a 424-unit

apartment community. It

paid $6.75 million, or $10.22

per square foot, for the land,

sold by Fashion Bar Associ-

ates.

The company’s equity part-

ner is Junius Real Estate Part-

ners, a JPMorgan subsidiary.

The light-rail station opens

later this year.

The community is a true

transit-oriented develop-

ment, said

B a r r y

DiRaimon-

do, CEO of

SteelWave,

based in

Foster City,

California.

“It truly

is,” DiRai-

m o n d o

said

in

a phone interview with the

Colorado Real Estate Journal.

“It is truly not even a 5-iron

shot from the station,” DiRai-

mondo said.

The three- and four-story

community will have high-

end finishes and all of the

amenities that residents

expect, but it will not be like

the luxurious apartments

being built around down-

town Denver, he said.

“This is working-bee hous-

ing,” DiRaimondo said.

“This is for the midlevel

executive who might work at

the Denver Tech Center or the

research people and young

physicians at the Fitzsimons

medical campus,” he said.

“We also will draw from

Buckley,” he added.

About 137,000 people work

in the tech center, Fitzsimons

and Buckley.

He expects average rents to

run about $1.60 per sf.

“We’re not looking at the

$3 (per square foot) rents you

are going to see in LoDo,”

DiRaimondo said.

Also, with an average size

of about 900 sf, the Iliff Sta-

tion development will be big-

ger than a typical new urban

community, he noted.

“We think it will fill a niche

that is really underserved,”

DiRaimondo said.

“I think if you look at the

appeal of this and the appeal

SteelWave, a new company with a long history, has bought 15 acres next to the Iliff Station light-rail

station in Aurora.

by Jill Jamieson-Nichols

�Amazon’s arrival in the

Denver market signals the

beginning of an e-commerce

push into the metro area.

“We have known for a long

time we’re going to see a real

growth of e-commerce in the

Denver market. It certainly is

exciting and really healthy for

the market to see this kind of

industry start to take off,” said

Tyler Carner, a CBRE indus-

trial specialist who was not

involved in the deal.

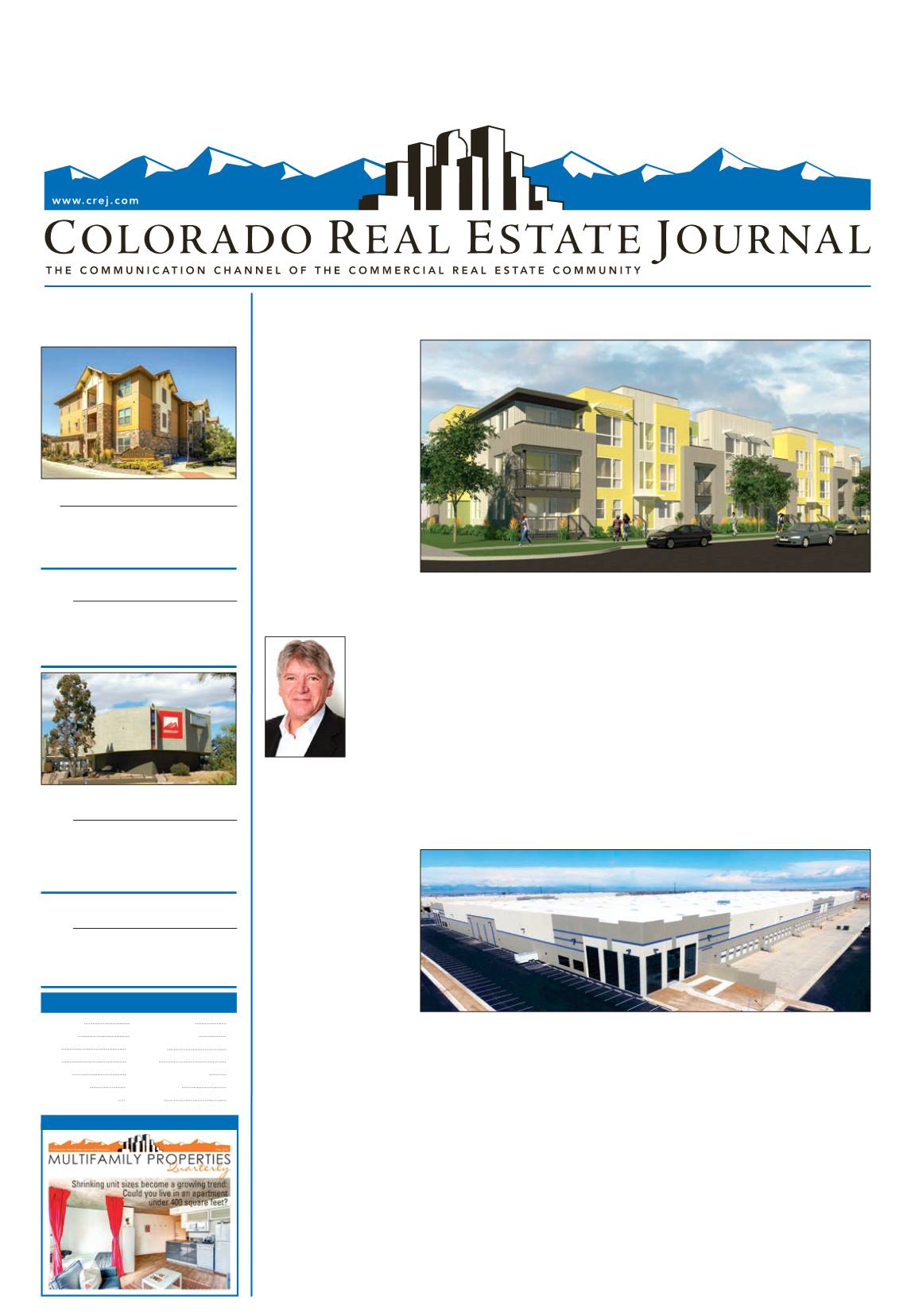

Amazon leased Majes-

tic Commercenter’s new

452,400-square-foot specula-

tive distribution building at

19799 E. 36th Drive in Aurora

for a package “sortation” cen-

ter, where products custom-

ers have ordered are sorted

and shipped to post offices

for delivery. The center will

speed up the delivery process

and allow the e-retail giant

to get packages to customers

on Sundays. Amazon Prime

members will be able to place

orders until 11:59 p.m. and still

get free two-day shipping.

“We are always looking for

ways to better serve custom-

ers, and this facility enables

faster delivery with later cut-

off times for orders,” spokes-

woman Ashley Robinson said

in an email. “We want tomake

sure we are placed as close to

the customer as possible to

ensure we can offer a great

Prime service and fast ship-

ping speeds to customers.”

Amazon is moving quickly

to open the center, which will

employ “hundreds” of work-

ers.Asked if therewill be relat-

ed facilities in the Denver area,

Amazon said it has “nothing

to announce at this time.”

Neither Majestic Realty Co.,

which owns the building, nor

the brokers who represent-

ed Amazon – Alec Rhodes,

Tyler Smith and Aaron Valdez

of Cushman & Wakefield –

would comment on the trans-

action.

The Rocky Mountain region

is not a huge distribution hub

because its population densi-

ty is low in comparison with

markets like Chicago, Los

Angeles and Houston, for

instance. But it is important

from a regional distribution

standpoint, and as e-com-

merce companies build out

their distribution networks

to get products to consumers

quickly, Denver and similar

markets come into play.

There currently are a cou-

ple of million-sf deals, and a

couple of 250,000-sf or larger

deals, in the market that are

e-commerce related, accord-

ing to Carner.

“If you look at these

e-commerce groups around

the country, they have these

large fulfillment centers and

they often have smaller dis-

tribution centers, often more

infill located. So we suspect

we will see some of those

going forward,” he said.

In addition, there are “mul-

tiple,” smaller e-commerce

deals in the market, he said,

adding third-party logis-

tics companies that supply

e-commerce companies also

will be looking for space.

“What we really are see-

ing, and will see, is growth

in everything from smaller,

25,000- to 50,000-square-foot

users connected to e-com-

merce to the larger e-com-

merce fulfillment centers,”

Carner said.

s

Majestic Commercenter’s 452,400-sf Building 29 will house Amazon’s “sortation,” or fulfillment, center.

Barry DiRaimondo

CONTENTS

Inside