April 5-18, 2017

-

Page 19

www.crej.comC

OLORADO

R

EAL

E

STATE

J

OURNAL

Rebchook Real Estate Corner

Millennials.

Every city

wants them.

Denver is

actually get-

ting them.

A fair share

of the 10,000

or so people

moving to

the

Mile

High City

every month

are in the coveted demographic

group. Many of these millennials

are renters, good news for the

Denver area multifamily market.

“Millennials are the biggest

generation ever” and also are the

most educated group ever, noted

John Burns, CEO of John Burns

Real Estate Consulting.

Burns, who is based in Califor-

nia, made those millennial com-

ments earlier this year at a ULI

Colorado event.

But Burns said that the word

“millennial” as a catchall defini-

tion for people born between 1984

and 2002 doesn’t make much

sense.

“If you are talking to millen-

nials born in the ‘80s and those

born in the 1990s, you will have

a much different conversation,”

Burns said.

He decided to dig deeper into

the demographic trends.

After three years and 9,000

hours of research, his firm came

up with eight different demo-

graphics to describe those born

in decades from the 1930s to the

2000s. Burns and co-author Chris

Porter summed up their find-

ings in a book: "Big Shifts Ahead:

Demographic Clarity for Busi-

ness."

“Denver looks a little different”

than other parts of the country,

Burns said.

“Denver is more skewed to

those born in the ‘80s and in the

‘70s than anywhere else in the

country,” he said.

Those born in the 1970s, he has

dubbed as the “balancers,” and

those born in the 1980s are the

“sharers.”

Those two millennial demo-

graphics account for 33.4 percent

of the Denver area population,

according to research by Burns.

The balancers, of course, want

everything: balance between

work, family and play.

The sharers are the earliest gen-

eration of millennials. They also

like social media, such as Face-

book, Instagram and Snapchat.

They also remember the hard eco-

nomic lessons of the Great Reces-

sion.

“They learned their lessons

from their parents and are afraid

of debt,” Burns said.

That is, other than student debt,

as they are saddled with much of

the $1.2 trillion in debt in the U.S.,

he pointed out.

Denver, he said, has been a

leader in master-planned com-

munities that

provide hous-

ing, retail and

offices in plac-

es such as Sta-

pleton, Lowry

andArvada.

“Give me

urban with

great schools

and you can’t

miss,” according to Burns.

These are what he calls “sur-

bans,” communities with subur-

ban and urban qualities.

“Give me cool urban in the sub-

urbs. Love that urban feel. Surban

sounds better than mixed-use,”

Burns said.

Because Denver skews younger

than much the U.S., that bodes

well for the apartment market,

according toChris Porter, the chief

demographer and researcher at

Burns, who in addition to being

the co-author of Big Shifts Ahead,

is the chief demographer and

researcher at Burns Real Estate

Consulting.

“Weknowright nowtheyoung-

er population is delaying many of

the big milestones in life, like buy-

ing a home, andnot necessarily by

choice,” Porter said.

“As a group, as they enter adult-

hood, they are tending to rent,”

Porter added. “That should boost

the apartment market, purely as a

demographic shift.”

Indeed, a national report

released last week by Florida

International University and

Florida Atlantic University said

that Denver is one of only three

cities in the nation where rent-

ing an apartment carries less risk

than buying a home. The report,

by Beracha, Hardin & Johnson,

ranked Denver with Dallas and

Houston because of rapidly rising

home prices.

“It probably does make more

sense to rent than to buy in Den-

ver right now,” Porter agreed.

On the other hand, he is not

down on the Denver housing

market, either.

In fact, it is somewhat of a Gold-

ilocks market — not too hot and

not too cold, according to Porter.

The younger population in

Denver also is good news for res-

taurants, he noted.

“One thing we are noticing and

something you will see across the

country is that younger buyers are

more cost-conscious,” Porter said.

“They don’t want to rely too

heavily ondebt and they use debit

cards instead of credit cards,” he

said.

At the same time, they are more

into “experiences than posses-

sions."

"They are willing to pay for

experiences. I think if retail and

restaurants can help create an

experience for them, that will res-

onate with them.”

▲

Millennials making it, mostly renting in Mile High CityJohn Rebchook

Rebchook Real Estate

Corner

John Burns

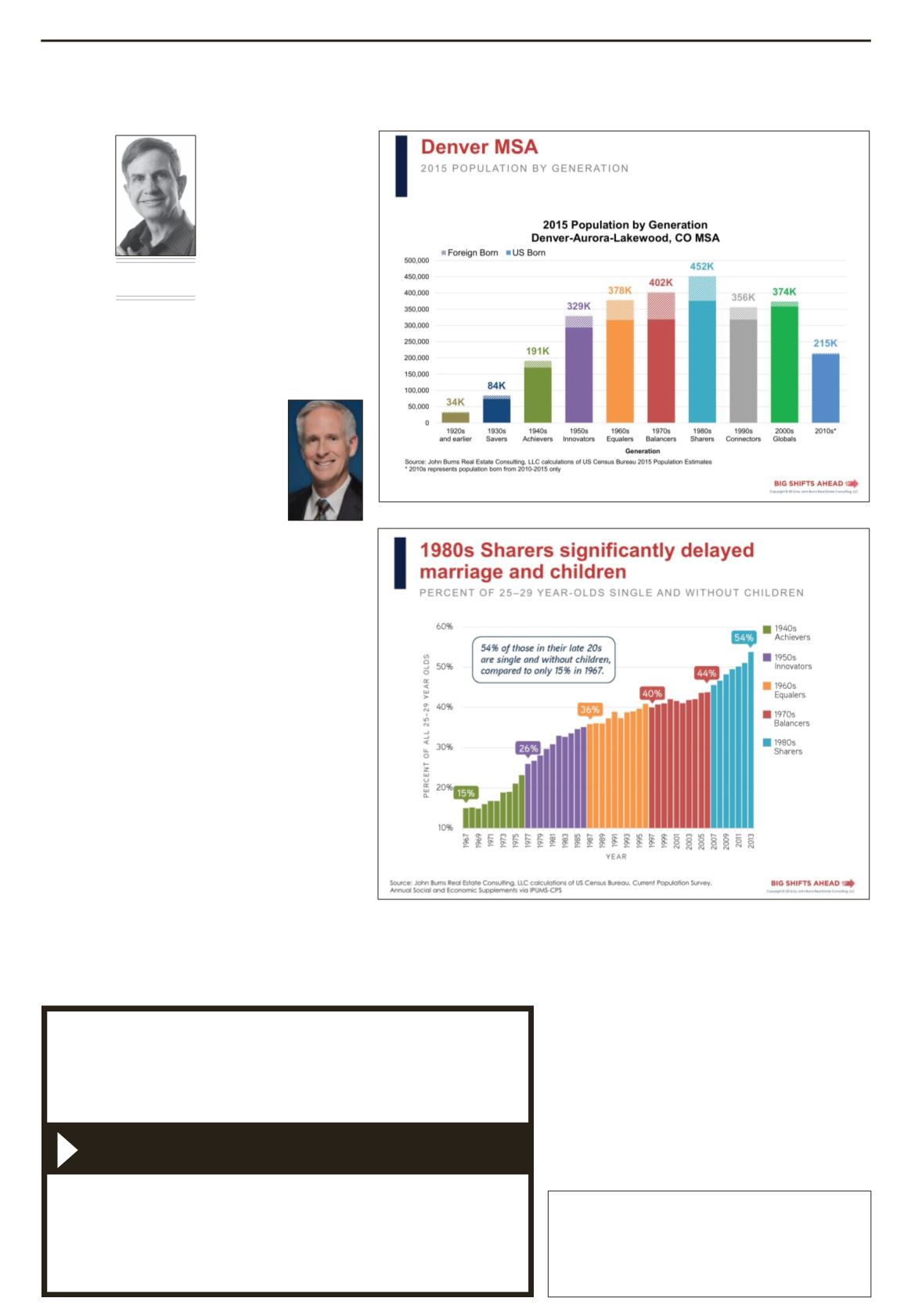

A snapshot of Denver area demographics by generation, rather than labels, such as baby boomers and millennials

Denver has more "sharers" than most cities. This is a generation that is delaying having children, which is

expected to boost the rental market.

See more Rebchook Real Estate Corner at

www.CREJ.com.John Rebchook’s regularly

posted blogs include commercial real estate

news stories, in-depth looks at deals, profiles,

Q&As and pieces on the latest trends. Contact

John with story tips at

JRCHOOK@gmail.comor 303-945-6865.

Advertise on the

Rebchook Real Estate Corner blog

www.crej.com/rebchook-real-estate-storiesTo reserve space please contact Lori Golightly

lgolightly@crej.com303.623.1148 x102

• Possible 2500 views per week

• Update 3x a week

• $500 per month

• Ad size: 300 x 250px

ll