Page 24

-

April 5-18, 2017

www.crej.comC

OLORADO

R

EAL

E

STATE

J

OURNAL

by Jennifer Hayes

Metropolitan Capital Advisors

Ltd. recently arranged two loans,

including construction financing

for the third phase of the Belle

Creek Commons project.

Charley Babb, senior director

and principal of Metropolitan

Capital Advisors’ Denver office,

and Tiffiany Mullins, senior asso-

ciate at MCA, placed the $4.12

million construction loan for the

Belle Creek Commons develop-

ment.

MCA arranged the debt financ-

ing on behalf of an entity spon-

sored by Chartered Development

Corp., a Denver-based develop-

ment company. The construction,

minipermanent financing has a 5

percent interest rate. Additionally,

the loan has prepayment flexibil-

ity.

The unnamed lender also pro-

vided the financing for the first

two phases of Belle Creek Com-

mons, where the first phase of

construction is complete and

Phase 2 is underway.

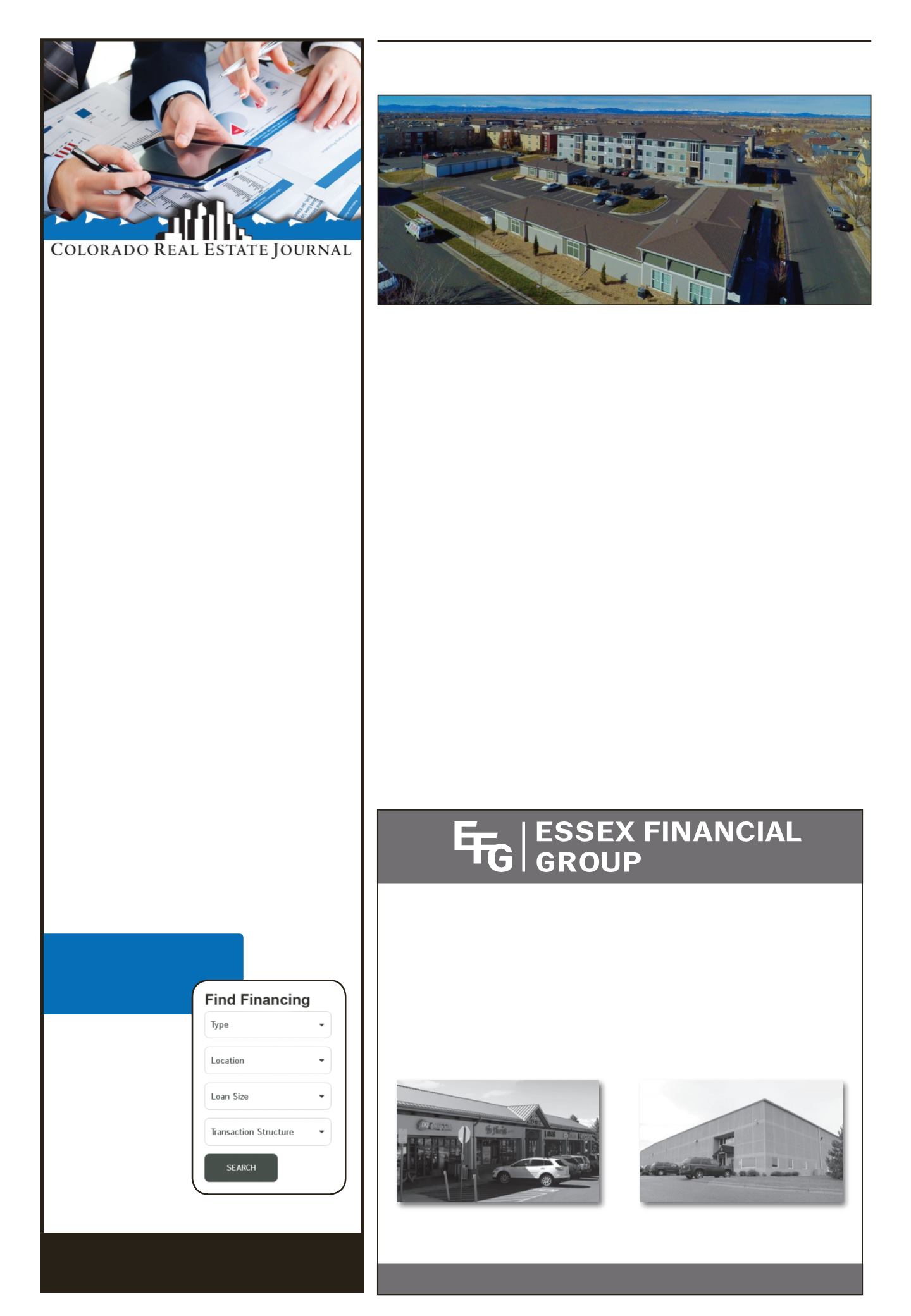

The third phase of the com-

munity at Belle Creek Commons

will include 24 apartments and 10

townhomes. Anticipated delivery

is this fall. A final, fourth phase

is planned with build out in the

first quarter of 2018. One-, two-

and three-bedroom apartments

include a patio or balcony, in-

unit washer and dryer and state-

of-the-art soundproofing. The

two-story townhomes with two

and three bedrooms feature an

attached two-car garage, 8- and

9-foot, ceilings, and in-unit wash-

ers and dryers.

At completion, Belle Creek

commons will comprise 177

market-rate units and complete

the full development of the Belle

Creek community at 9444 E 108th

Ave. in Henderson. In addition to

the apartments and townhomes,

the master-planned Belle Creek

community features single-fam-

ily homes, community gardens,

membership to the Belle Creek

Family Center & YMCA, free

community events, such movies

in the park, and walkability to

retail and restaurants as well as

the Bell Creek K-8 Charter School.

“The thing I found so exciting

was that the developer was able

to deliver this quality of housing

at this price in the current market.

This is really what got me excited

about taking this assignment,”

said Babb.

MCA also arranged a $3.5

million, fixed-rate loan for Shift

Workspaces-Corona.

Babb and Mullins placed the

loan with a community credit

union located in Denver. The

10-year full-term loan includes a

seven-year term fixed at 4 percent

and a 25-year amortization.

Shift Workspaces-Corona, at the

intersectionof East FourthAvenue

and Corona Street in Denver, fea-

tures a collaborative co-working

office space with fully amenitized

workspaces ranging from private

offices, designated desks and co-

working space with a collabora-

tive conference room and event

space. Additionally, Shift includes

a full kitchen stocked with coffee

and beverages and an on-site fit-

ness facility and yoga studio.

▲

MCA arranges financing for Belle Creek, Shift Workspaces-CoronaI N D U S T R Y D I R E C T O R Y

COMMERCIAL REAL ESTATE

LENDERS

Arbor Commercial

Mortgage, LLC

Bank of America Merrill

Lynch – Commercial

Real Estate

Bank of Colorado

Bank of the West

Berkadia Commercial

Mortgage, LLC

Bloomfield Capital

Partners, LLC

CBRE|Capital Markets

Chase Commercial Term

Lending

Citywide Banks

Colorado Business Bank

Colorado Lending Source

Commerce Bank

Essex Financial Group

FairviewCommercialLending

FirstBankHoldingCompany

Front Range Bank

Grandbridge Real Estate

Capital LLC

Hunt Mortgage Group

JVSC-CBRECapitalMarkets

KeyBankN.A.,KeyBankReal

Estate Capital

Merchants Mortgage and

Trust Corp.

Midland States Bank

MontegraCapitalResources,

Private Lender

Mutual of Omaha Bank

NorthMarq Capital, Inc.

RNB Lending Group

TCF Bank

TerrixFinancialCorporation

U.S. Bank – Commercial

Real Estate

Vectra Bank Colorado, N.A.

Westerra Credit Union

@ FIND FINANCING SEARCH TOOL crej.com/lenders

profiles

photos

contacts

social links

videos

and more

GET LISTED

LoriGolightly|303-623-1148x10

2|lgolightly@crej.comEssex Financial Group is the preeminent commercial mortgage banking

rm in the Rocky Mountain Region, specializing in commercial real estate

debt and equity placement with the following capital providers:

Highlands Ranch Marketplace

Highlands Ranch, CO

$8,500,000 Permanent Loan

Life Insurance Company

Cardinal Glass Distribution Building

Hudson, WI

$10,595,000 Permanent Loan

Bank

Essex Financial Group | 1401 17th Street, Suite 700 | Denver, CO 80202

303-796-9006

| www.essexfg.comExclusive Life Insurance Company Correspondent Relationships

CMBS Conduit Lenders

Debt Funds

Bridge Lenders

National & Regional Banks

Government Agencies

Credit Tenant Lease Financiers

Private Capital Sources

Finance

Construction financing was provided for the third phase of the Belle Creek Commons project in Henderson.