Page 2AA —

COLORADO REAL ESTATE JOURNAL

— November 19-December 2, 2014

Office

by Jill Jamieson-Nichols

Parallel Capital Partners Inc.

made its first acquisition in the

Denver market with the $23 mil-

lion purchase of Tamarac Plaza,

whichwill undergomajor renova-

tions and upgrades.

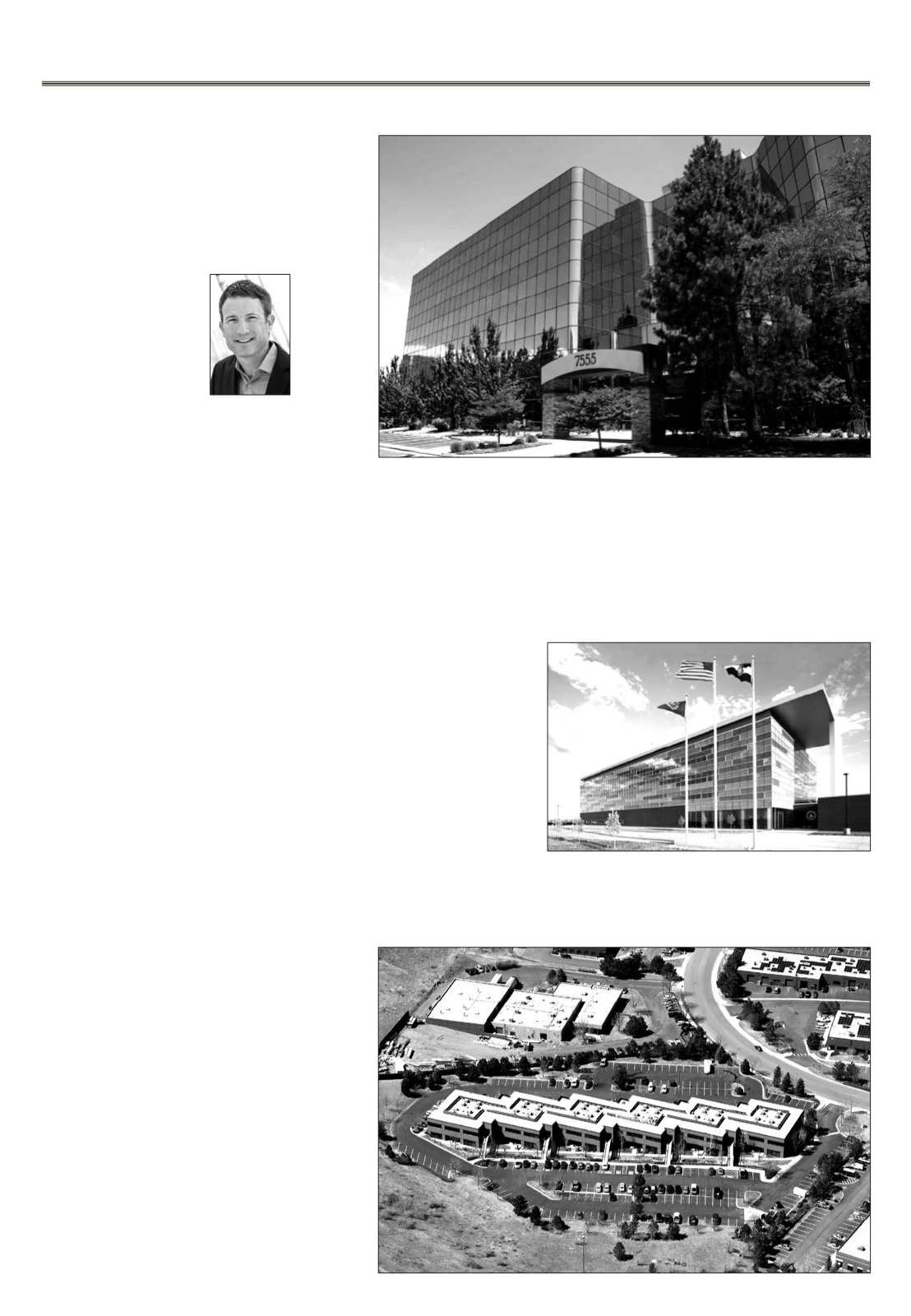

Tamarac Plaza is a three-build-

ing, 355,269-square-foot Class B

office complex at 7535, 7555 and

7600 E. HampdenAve. in Denver.

The buildings, known as Tamarac

Plaza I and II and Argosy Plaza,

occupy a nearly 12-acre campus

with mature landscaping, seating

and walkways.

San Diego-based Parallel Capi-

tal Partners will invest more than

$7 million in the property to bring

it up to Class A status, according

to CEOMatt Root.

"We will enhance the common

areas, including new common

conference facilities, lobby and

corridor finishes, andmodernized

elevators, as well as create spec

suites," said Root. The buyer also

will install new mechanical sys-

tems, new way-finding signage

and new roofing.

The five- and six-story build-

ings, along with three parking

structures, were constructed by

Trammell Crow Co. in 1980-1984.

Seller LNR Partners LLC recently

completed a $4 million renova-

tion of the campus, which now

features a state-of-the-art fitness

facility, upgraded, contemporary

lobbies and common areas.

Occupancy was 60 percent at

the time of the sale, with anchor

tenants including Farmers Insur-

ance, Financial Planning Associa-

tion and Western Sugar Coopera-

tive.

“This latest acquisition furthers

our core mis-

sion of acquir-

ing irreplace-

able, value-

added com-

mercial real

estate in key

Western mar-

kets,” Root

said. “With

a f f o r d a b l e

housing, an

abundance of

outdoor recreational and a central

geographic location, Denver has

surged into the national spotlight

in recent years, andwe are thrilled

to now have a presence here.

“The property was attractive to

us for multiple reasons, including

its ideal location just east of I-25

and 15 minutes from downtown,

as well as close proximity to the

Denver Technological Center, the

Southmoor light-rail station and

dozens of restaurants, hotels and

retail centers.”

The company retained Cush-

man & Wakefield to implement

the improvements and CBRE to

implement the leasing strategy.

AccordingtoRoot,Parallelfocus-

es primarily on long-term growth

markets that have high barriers to

entry for the development of new

commercial product, a reputation

for highqualityof life anda history

of long-term job formation. “The

Denver market meets all of these

criteria, and we are currently pur-

suing two additional office acquisi-

tions in this market."

Parallel Capital Partners is a pri-

vate, fully integrated real estate

investment and operating com-

pany that acquires value-added

and core-pulls opportunities for its

own account in primary and sec-

ondarymarketswest of theMissis-

sippi River, including Hawaii.

s

Tamarac Plaza I is among three buildings that make up the Tamarac Plaza campus.

Matt Root

by Jill Jamieson-Nichols

An investment advisory firm

launched a multimillion-dol-

lar North America investment

strategy with the acquisition of

an interest in the FBI’s Denver

Field Office.

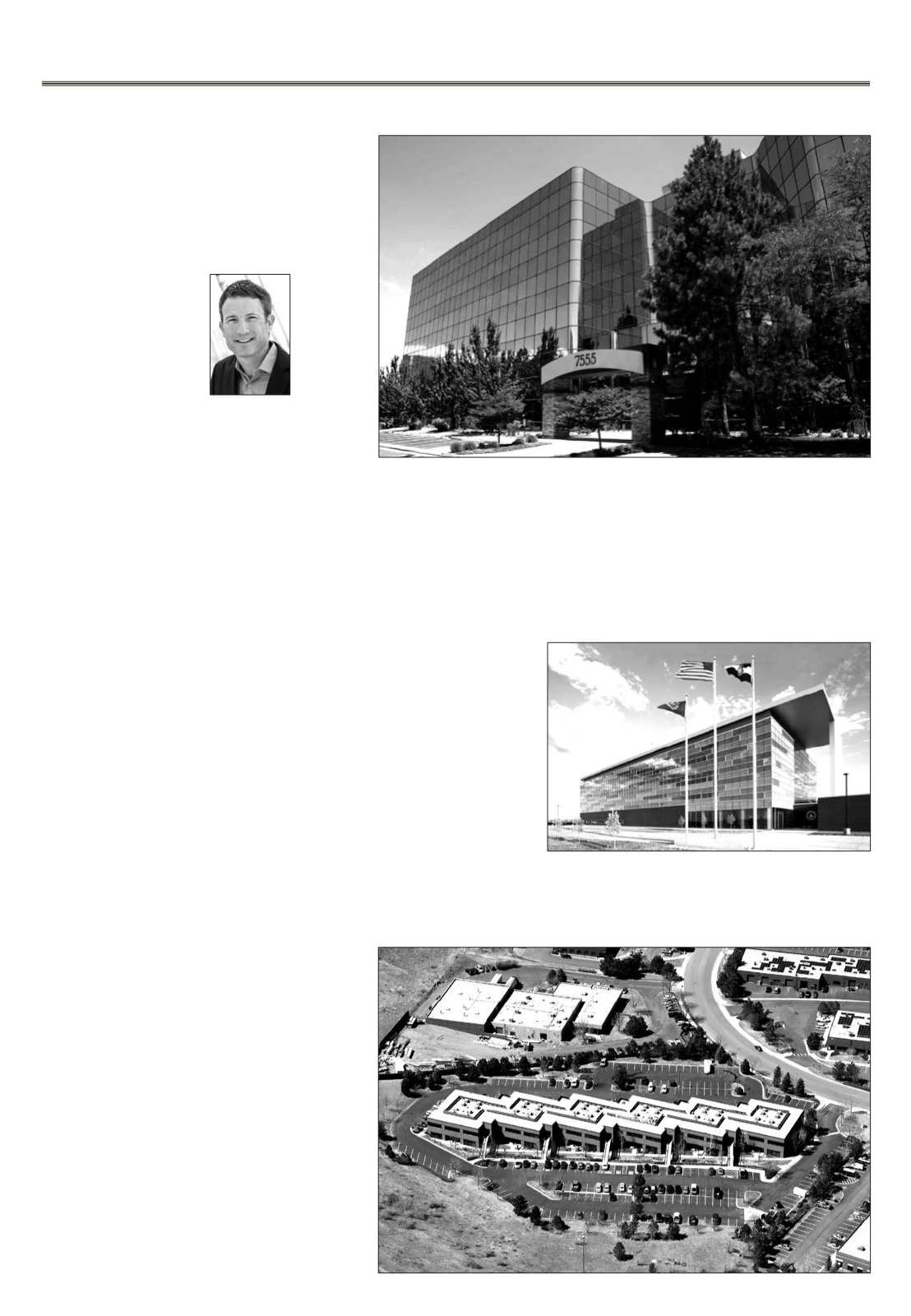

Investment in the 175,155-

square-foot property at 8000 E.

36thAve. kicks off 90 North Real

Estate Partners’ strategic plan to

acquire $750 million worth of

socially responsible real estate

investments over the next 18 to

24 months. It will focus on core

assets ranging from $40 million

to $100 million in major U.S.

markets.

Chicago-based 90 North

advised an international insti-

tutional investor on the invest-

ment withAlex S. Palmer & Co.,

the building’s Nashville-based

developer. It didn’t release the

value of the transaction or level

of interest acquired.

A build-to-suit completed in

2010, the FBI property hous-

es the agency’s Colorado and

Wyoming field operations. It

includes approximately 144,000

sf of four-story, Class A office

space with an approximately

31,000-sf annex and land for

44,000 sf of expansion.

The office space ranks No.

2 in the state for Energy Star

certification, and the overall

property holds a No. 3 ranking.

The building also placed 228th

nationally among 3,200 compet-

itors for energy use reduction,

and 30th nationally and fourth

in Colorado for a 23 percent

reduction in water usage.

Located in Stapleton, it is

approximately a quarter-mile

from the Interstate 70/I-270

interchange and two blocks

from a planned East Rail Line

station scheduled to open in

2016. The location suits gov-

ernment security requirements

as well as its need for “excel-

lent” highway access to Den-

ver’s central business district

and Denver International Air-

The building at 8000 E. 36th Ave. houses the FBI’s Colorado and

Wyoming field operations.

by Jill Jamieson-Nichols

A small-tenant office property

on the west side of the Denver

area traded to a local buyer for

$5.53 million.

The 61,200-square-foot prop-

erty at 651 Corporate Circle in

Golden represented a value-add

opportunity for buyer Ogilvie

Properties, according to Patrick

Devereaux, executive vice presi-

dent in JLL’s Denver Capital

Markets Group.

The building was 78 percent

leased, offering upside in leas-

ing the vacant space and in

existing rents, said Devereaux.

Devereaux represented the

seller, an entity affiliated with

Michigan-based ATMF Realty,

with JLL Executive Vice Presi-

dent Jason Schmidt.

“It’s a good value-add

opportunity in that supply

constrained west Denver mar-

ket,” said Devereaux. Accord-

ing to Devereaux, there is sig-

nificant tenant activity in the

area. “There is a rising rental

rate environment in west Den-

ver. The buyer wanted to take

advantage of that and increase

occupancy and increase value.”

The two-story building is

located along U.S. Highway

40 (West Colfax Avenue), just

off Interstate 70 and C-470. The

location makes it easily acces-

sible to those highways, as well

as West Sixth Avenue and U.S.

Highway 93. “It has tremen-

dous access,” said Devereaux.

The property is within MIE Cor-

porate Center and “very much

an infill-type location in west

Denver,” he said.

Cooling Tower Depot, a cool-

ing tower manufacturing com-

pany, and Environcon, which

does environmental remedia-

tion and related services, are the

largest of 13 tenants in the build-

ing, which includes a number of

engineering-related companies.

Built in 2001, 651 Corporate

Circle occupies a 5.15-acre site

with 4.3 parking spaces per

1,000 sf.

s

The two-story building at 651 Corporate Circle in Golden is within MIE Corporate Center, which offers quick

access to Interstate 70, C-470 and other major transportation corridors.